1. The property market is heavy! The down payment ratio and the first set of interest rates should be lowered, and the central bank and other departments will jointly make good profits.

Importance: ★★★★★★★

On the evening of January 5th, the People’s Bank of China and China Banking and Insurance Regulatory Commission established the first dynamic adjustment mechanism of housing loan interest rate policy. In cities where the sales price of newly-built commercial housing has decreased month-on-month and year-on-year for three consecutive months, the lower limit of the local first home loan interest rate policy can be maintained, lowered or cancelled in stages.

At the same time, Ni Hong, Minister of Housing and Urban-Rural Development, pointed out that those who buy the first house should be strongly supported. The down payment ratio and the first set of interest rates should be lowered. For the purchase of a second house, we should give reasonable support. Trade-in the old for the new, trade-in the small for the big, and give policy support to families with many children. For the purchase of more than three sets of housing, it is not supported in principle, that is, it does not leave room for speculative real estate speculators to re-enter the market.

Six departments, including Shenzhen Housing and Construction Bureau, issued the Work Plan for Promoting the "Transfer with Mortgage" Mode of Second-hand Housing in Shenzhen to promote the "Transfer with Mortgage" mode of second-hand housing and reduce the transaction cost of second-hand housing.

Tencent’s stock selection statistics show that the main funds have flowed into the top real estate stocks in the past week for readers’ reference only. The data shows that in the past week, China Merchants Shekou ranked first with a net inflow of 200 million yuan, followed by Vanke A, Digital Source Technology and Binjiang Group with a net inflow of more than 100 million yuan.

2. In 2023, the "construction drawing" of state-owned enterprise reform was released, and eight key points of reform and development were clarified.

Importance: ★★★★★

On January 5th, the State-owned Assets Supervision and Administration Commission held a meeting of heads of central enterprises in Beijing. The meeting pointed out that in 2023, it is necessary to take advantage of the situation and organize a new round of deepening and upgrading of state-owned enterprise reform. Actively and steadily classify and deepen the reform of mixed ownership; Promote medium and long-term incentives to expand and improve quality. It is necessary to further promote the layout optimization and structural adjustment of state-owned capital, and formulate guidelines for the adjustment of layout structure in key industries such as energy conservation and environmental protection and construction. At the same time, it is necessary to increase investment in new infrastructure construction such as 5G, artificial intelligence, data center, satellite Internet, industrial Internet platform and Internet of Things platform.

3. What is the signal that foreign capital has bought more than 12.7 billion yuan and invested heavily in leading stocks such as Maotai?

Importance: ★★★★

Northbound funds bought 12.753 billion yuan yesterday. Wuliangye and Maotai, liquor "Shuangxiong", topped the list with net purchases of 1.532 billion yuan and 1.402 billion yuan respectively, while China Ping An, Contemporary Amperex Technology Co., Limited and Oriental Fortune were among the top net purchases.

It is worth noting that the data shows that since November last year, northbound funds have accumulated a net purchase of A shares of 109.06 billion yuan. In the near future, stocks including China Testing, qiaqia Food and Midea Group have been "snapped up" by foreign investors.

According to China, a brokerage firm, some analysts said that the inflow of northbound capital is often the forerunner of other capital inflows, and it does not rule out the expectation of incremental capital brought by the "spring agitation" in the market.

4. BYD "looks up" and "Easy Sifang" technology is concerned. These companies have a layout.

Importance: ★★★★

On January 5th, BYD held a brand-new high-end brand launch conference, and the first flagship off-road SUV and electric sports car were officially unveiled at U8 and U9. According to reports, looking up at the two models equipped with four-wheel independent wheel-side motors, BYD calls it "easy quartet" technology, which can output through four-wheel four-motor and steer without relying on steering mechanism, and can truly realize 360-degree steering in situ.

Wolong electric drive has technical reserves in related fields of wheel-side motors, and the company is developing a wheel-side motor for ZF. Hekang Xinneng has technical reserves in the field of wheel-side motors.

5. The electrolytic nickel project of Chuanqingshan Group has been officially put into operation, and the price of nickel has gone down sharply.

Importance: ★★★★

As of the afternoon closing of the domestic futures market on January 5, the main contract of Shanghai Nickel fell by more than 5.19% to 220,300 yuan/ton. In the past December, 2022, the monthly increase of the main contract of Shanghai Nickel was close to 17%. The price of nickel in the outer disk also dropped sharply overnight. As of the close of January 5, local time, the three-month nickel on the London Metal Exchange (LME) fell by more than 6%.

On the evening of January 4th, Beijing time, news came from the market: At present, the nickel electrowinning project of "Nickel King" Qingshan Group has been officially put into production, with a preliminary design capacity of 1,500 tons per month, which is produced by a new energy enterprise in Hubei, and some of its volume will be released in January.

6, 2499 yuan/bottle! Maotai Year of the Rabbit Zodiac Wine was officially launched, and digital collections were introduced for the first time.

7. Joint prevention and control mechanism in the State Council: On January 8th, mainland residents will resume to apply for travel and business endorsements to Hong Kong.

8. Does the IPO declaration of the main board set the industry "red and yellow lights"? Investment bankers: There are indeed new restrictions on some epidemic prevention enterprises.

9. The quotation of silicon materials dropped by nearly 40% in two months, and the organization judged that silicon wafers are expected to take the lead in stabilizing.

10. Passenger Association: It is estimated that the wholesale sales volume of new energy passenger car manufacturers in December will be 730,000.

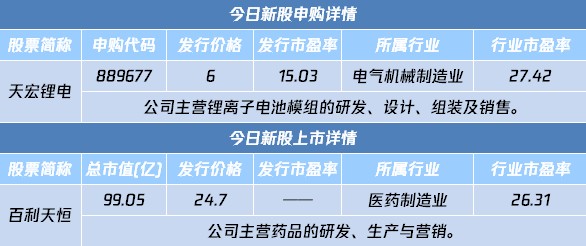

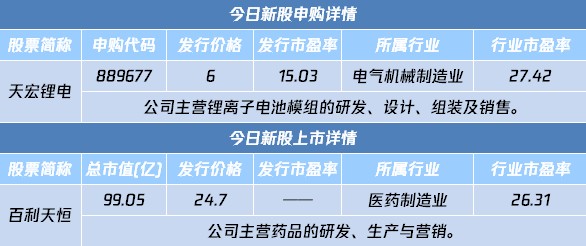

Brother Optional reminds me that today, the new share Tianhong Lithium Battery of Beijing Stock Exchange is subscribed, and the new share Baili Tianheng of science and technology innovation board is listed.

1. At 10:00, the State Council held a press conference on doing a good job in Spring Festival travel rush’s service guarantee.

2. Monthly CPI rate of December in Eurozone at 18:00.

3, 21:30 US unemployment rate in December

4. At 21:30, the non-agricultural employed population in the United States after the seasonal adjustment in December.

After sorting out the investment opportunities concerned by the market, AutoBrother found that real estate, high-end innovative medical devices, and science and technology innovation board Company, a regional company in Shanghai, were highly concerned.

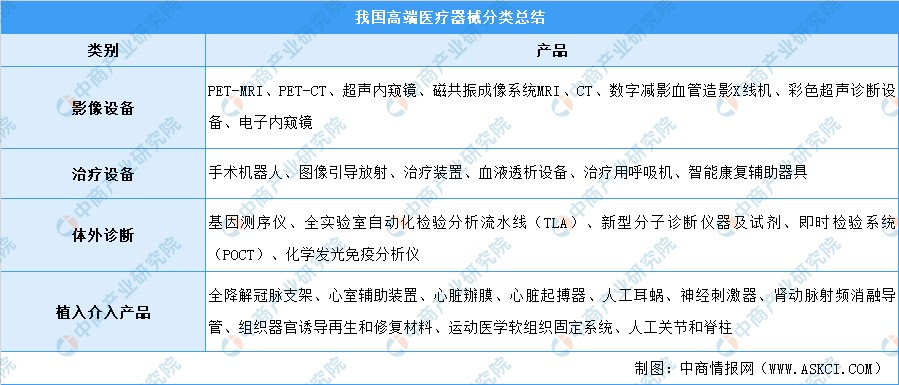

1. The Food and Drug Administration promotes the development and listing of high-end innovative medical devices. Many institutions are optimistic about Mindray and other stocks.

On January 5th, the National Conference on Drug Supervision and Administration was held in Beijing. The meeting pointed out that promoting the research and development of high-end innovative medical devices.

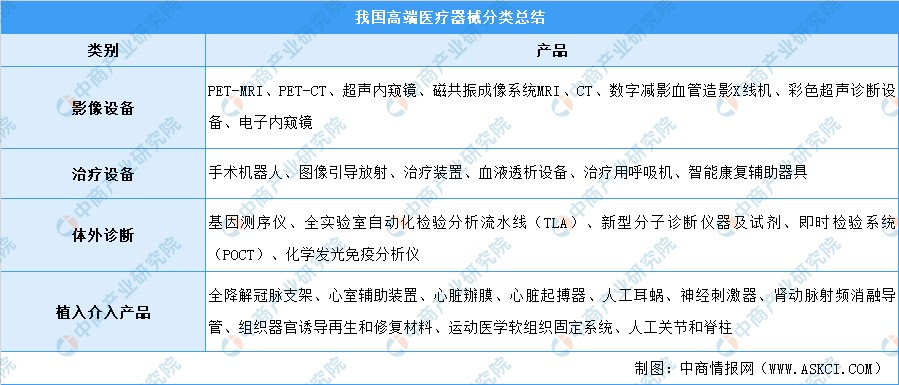

At present, China’s high-end medical devices are mainly divided into four categories: imaging equipment, therapeutic equipment, in-vitro diagnosis and implanted interventional products.

Tencent’s self-selected stocks have counted the list of medical device stocks favored by institutions in the past three months for readers’ reference only. According to the data, Mindray Medical ranked first among 29 institutions in the past three months, followed by Antu Bio, Kaijian Medical and Lepu Medical, which all received more than 12 institutional buy ratings.

2. Shanghai bancassurance industry supports Science and Technology Innovation Center institutions to favor Shanghai local science and technology innovation board companies.

After the close of trading on January 5th, Kechuang Company welcomed a positive boost: The Action Plan for Shanghai Banking and Insurance Industry to Support the Construction of Shanghai Kechuang Center (2022-2025) was issued.

According to iFinD data, among A-share bank insurance companies, Shanghai is the province of Bank of Communications, Shanghai Pudong Development Bank, Shanghai Bank, Shanghai Rural Commercial Bank and China Pacific Insurance.

In addition, Tencent’s self-selected stocks have counted the list of companies that are favored by institutions in the past three months and belong to the Shanghai regional plate and are science and technology innovation board, for readers’ reference only. The data shows that in the past three months, Lanqi Technology ranked first among 22 institutions, followed by Paineng Technology, Zhongwei Company, Aohua Endoscope, Jingchen Co., Ltd. and Haoyuan Medicine, which all received more than 10 institutional buy ratings.

3. Automobile Association: It is estimated that the national sales volume of new energy passenger cars will be 730,000 in December, which is expected to hit a record high for passenger car manufacturers.

4. State-owned enterprise reform | State-owned Assets Supervision and Administration Commission: Organize a new round of deepening and upgrading of state-owned enterprise reform.

5. Network Security | National Network Information Office: Strengthen the construction of digital China and maintain network security and data security.

6. Meta Universe | Baidu will release the world’s first heavy product on the 10th, and the meta universe will be as popular as the website of PC era in the future.

7. The upstream price of photovoltaic | photovoltaic industry chain has dropped significantly, and the demand or volume of related consumables has dropped.

8. Ophthalmology | The Science and Technology Daily published a document saying that there is probably an eye tendency in Covid-19.

Guohai Securities believes that the degree of recovery of economic fundamentals is more about the height of the stock market’s rise, but the overall recovery of the market is a foregone conclusion; Essence Securities believes that the strategic allocation of military white horses focuses on aviation, aerospace and informatization.

1. Guohai Securities: The overall recovery of the market is a foregone conclusion.

Guohai Securities said that the A-share market is currently in an upward trend from the current market volume and long-short pattern. This process may be repeated, but the short-term inertia still exists, and the strong favorable expectations in the medium term are gradually being fulfilled. In the medium and long term, the degree of recovery of economic fundamentals is more likely to affect the stock market’s rise, but the overall recovery of the market is a foregone conclusion.

2. Founder Securities: The current valuation of the banking sector is at a low level in the past decade.

Founder Securities believes that the Central Economic Work Conference in 2022 clarified the tone of "keeping the word steady and striving for progress" in 2023, and it is expected that the policy effect of subsequent steady growth will gradually emerge. At present, the valuation of the banking sector is at a low level in the past decade, and the improvement of macroeconomic expectations will further promote the repair of the valuation. In terms of individual stocks, it is suggested to grasp two main lines. The first main line is the city rural commercial banks in high-quality areas; The second main line suggests paying attention to some high-quality joint-stock banks whose valuations have dropped significantly due to the impact of real estate risks since 2022.

3. Essence Securities: strategically deploy the white horse of military industry, focusing on aviation, aerospace and informatization.

Essence Securities Research Report said that in 2022, the CSI Military Industry Index fell by 25.74%, ranking 28th. The demand for the 14th Five-Year Plan was released rapidly, and the industry changed from high-speed growth to high-quality development: from focusing on R&D to light production, R&D and production went hand in hand. During the 13th Five-Year Plan period, national defense science and technology made breakthroughs in major scientific and technological projects, core key technologies and other fields, and the intergenerational differences in weapons and equipment have been filled, and the development of the industry has entered the stage of supplementing quantity from supplementing quality. The overall growth rate of the military industry is relatively fast, and the index performance does not match the growth rate. Strategic deployment of military white horse, focusing on aviation, aerospace, informationization, unmanned, new materials and so on.

On the positive side, the self-selected brother prompted to pay attention to the positive data of Kangxinuo mRNA vaccine; In terms of negative announcements, we are concerned that Zixin Pharmaceutical was filed by the CSRC.

Positive announcement

1. Kangxinuo: novel coronavirus mRNA vaccine CS-2034 has obtained positive data in a clinical study to evaluate the safety and immunogenicity of sequential strengthening.

2. Abison: It is estimated that the net profit in 2022 will be 180-230 million yuan, with a year-on-year increase of 501.16%–668.15%.

3. Zhenhua New Materials: It is estimated that the net profit will reach 1.22 billion-1.3 billion yuan in 2022, up by 195.70%-215.09% year-on-year.

4. Chemical Engineering of Ganhua: It is estimated that the net profit will reach 90 million yuan to 125 million yuan in 2022, up by 183% to 292% year-on-year.

5. Yuntianhua: It is estimated that the net profit will reach 5.8 billion yuan to 6.1 billion yuan in 2022, with a year-on-year increase of 59.26% to 67.49%.

6. Xinhua Pharmaceutical: The subsidiary company obtained the registration certificate of ibuprofen suspension.

Negative announcement

1. Zixin Pharmaceutical Co., Ltd.: The company and the original actual controller Guo Chunsheng received the notice of filing a case from the China Securities Regulatory Commission because of the alleged violation of information disclosure.

2. An Naier: The company and relevant personnel received a warning letter from Shenzhen Securities Regulatory Bureau.

3. Tom Cat: Wang Jian’s insider trading company shares received an advance notice of administrative punishment.

4. Infineon replied to the letter of concern of Shenzhen Stock Exchange: the rumors of company restructuring are untrue, and there is no inter-temporal adjustment of profits in the impairment of goodwill.

5. Energy-saving Guozhen: Changjiang Environmental Protection Group and its concerted action plan to reduce the company’s shares by no more than 5%.

6. Tengjing Technology: Shareholders intend to reduce their shares by no more than 3.8%.

Judging from the proportion of lifting the ban, the proportion of lifting the ban will reach 79.52% in the next five days, followed by Chuangyao Technology and Heyuan Gas. Judging from the market value of lifting the ban, shares such as Power Production Finance, Tianyue Advanced and Miaokelanduo are among the top in the market value of lifting the ban.

The optional brother suggested that "small non-agricultural" strengthens interest rate hike expectations! The three major stock indexes of U.S. stocks all fell by more than 1%, while China almost rose by more than 14% in three days, while Shanghai Multiplier Branch rose by more than 206%. New york gold futures prices closed down, while US WTI crude oil futures closed higher.

1. US stock market: US stocks closed down on Thursday. Economic data showed that the US labor market remained strong, which strengthened investors’ expectation that the Fed would continue to raise interest rates to curb inflation.

2. Chinese stocks: Most of the popular Chinese stocks rose on Thursday, and the Nasdaq Golden Dragon Index closed up about 1.6%. Shang Multiplier Branch rose over 206%, Zhifu Financing rose over 75%, Yingxi Group rose over 52%, Jianzhi Education rose over 50%, and Dada Group rose over 28%.

3. Precious metal market: new york gold futures prices closed down on Thursday, ending the previous four consecutive trading days of rising prices.

Gold futures for February delivery in the New York Mercantile Exchange closed down $18.40, or 1%, at $1,840.60 an ounce.

4. Crude oil market: US WTI crude oil futures closed higher on Thursday, partially recovering the losses caused by the previous two consecutive trading days. On Thursday, the us energy information administration (EIA) reported that the decline of crude oil, gasoline and distillate stocks in the United States last week was less than market expectations.

5. European stock market: Germany’s DAX30 index closed down 0.36% on Thursday, Britain’s FTSE 100 index rose 0.63%, France’s CAC40 index fell 0.22%, Europe’s Stoxx 50 index fell 0.37%, Spain’s IBEX35 index rose 0.54%, and Italy’s FTSE MIB index fell 0.14%.

This article is edited from "Tencent’s stock selection"; Zhitong Finance Editor: Wang Jie.