The business model and growth are lackluster, and profitability is mediocre.

"Ordering takeout" is the norm in many people’s lives. The "yellow and blue army" dressed in uniform and equipped with standard takeout boxes has also become the bright scenery of the city.

Behind the huge group of riders is a rapidly growing instant delivery ("ready-to-match") market, with the service scene dominated by food and beverage takeout, including intra-city retail, smart pharmacies, and errand services.

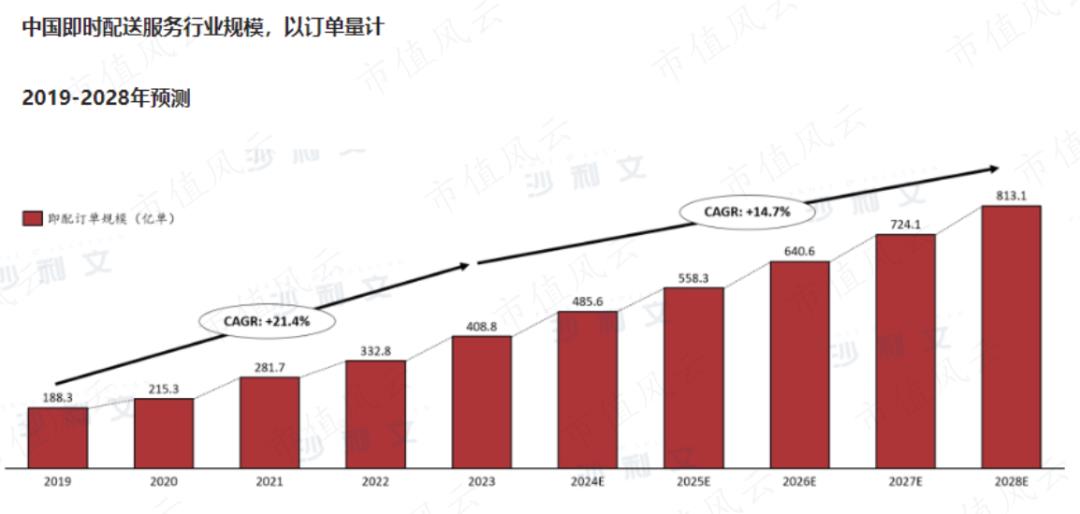

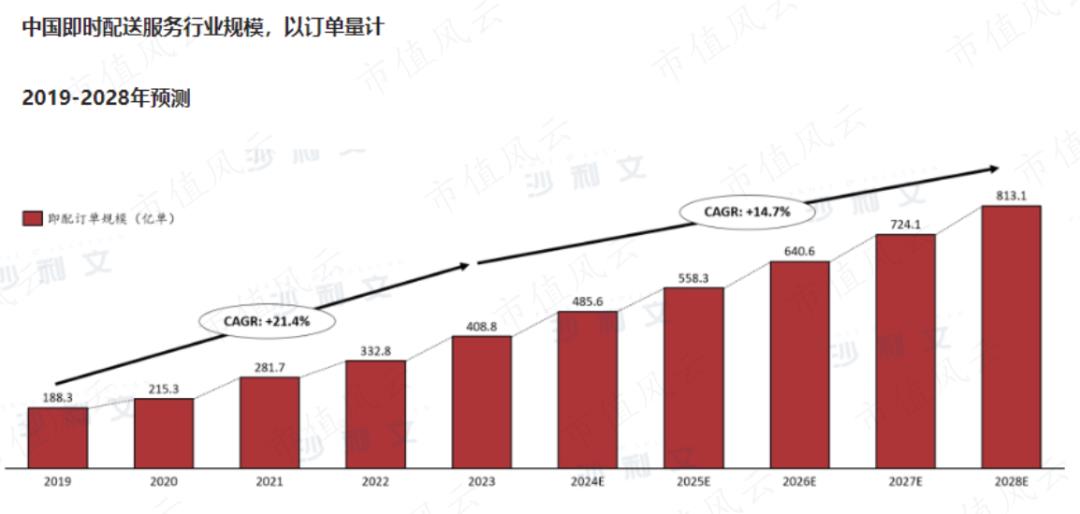

According to Sullivan data, in 2023, China’s ready-to-match industry-wide order scale reached about 40.88 billion orders, an increase of 23% year-on-year, and an average annual compound growth rate of 21% in the past five years.

(Source: Sullivan’s "2023 China Instant Delivery Industry Trends White Paper")

The pomp is also reflected in the financial report of Meituan (03690.HK): in 2023, revenue 276.70 billion yuan, net profit 13.90 billion yuan, turning a profit from the previous year and hitting a record high. At present, Meituan’s market value exceeds 700 billion Hong Kong dollars.

Due to factors such as reducing labor costs and avoiding legal risks, it has become routine for Internet platforms to outsource ready-to-distribute services to third-party enterprises.

Meituan said in an interview in May 2021 that the platform had nearly 10 million of outsourced riders.

And the third-party outsourcing companies that directly undertake the task of ready-to-match, and are responsible for recruiting and managing riders, are they backed by big trees to enjoy the shade and eat and drink together?

Recently, BridgeHR Tech ("Boltier", "Company") submitted a prospectus to the Hong Kong Stock Exchange, revealing the truth of the industry.

Clients reveal secrets

The company’s predecessor can be traced back to Suzhou Oufu, which was established in 2013, and has been involved in the field of human resources services.

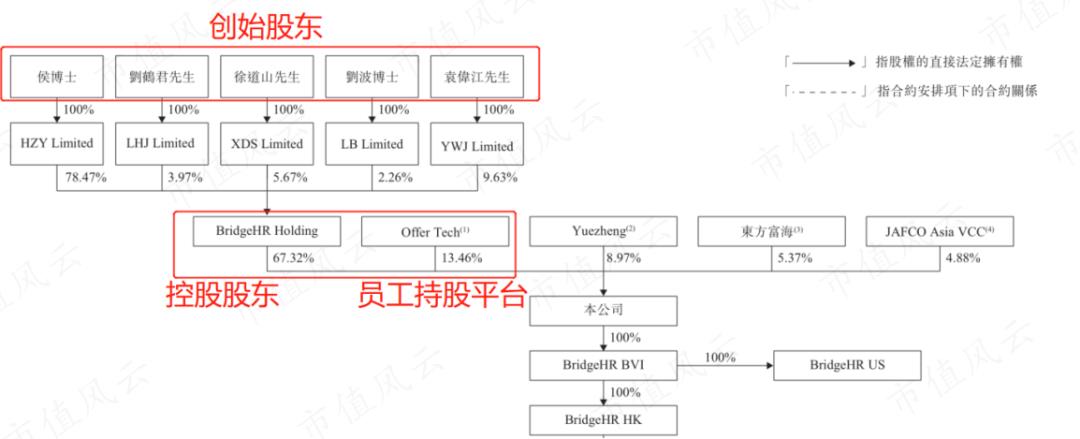

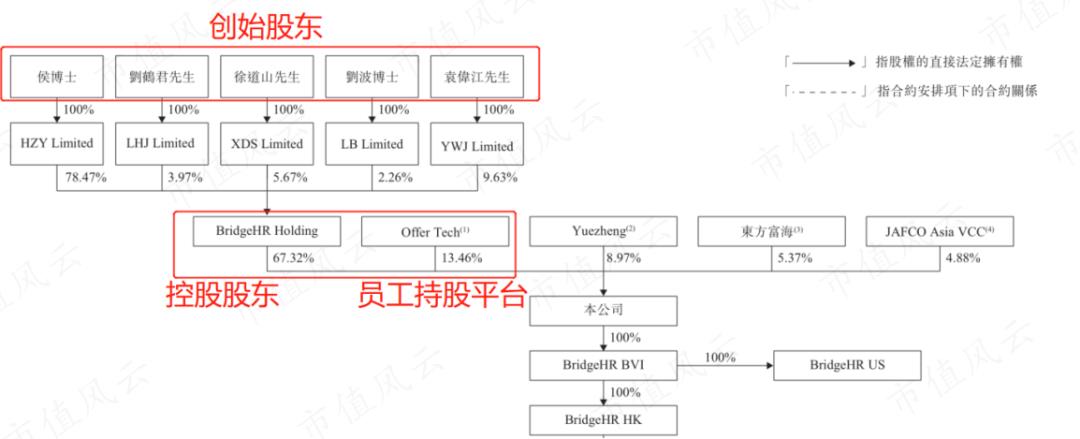

Hou Zhengyu, Liu Hejun, Xu Daoshan, Liu Bo, and Yuan Weijiang are the founding shareholders of the company and are acting in concert. As of the IPO, they hold a total of 80.78% through BridgeHR Holding and Offer Tech.

(Source: Company Prospectus)

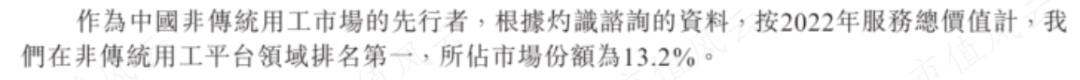

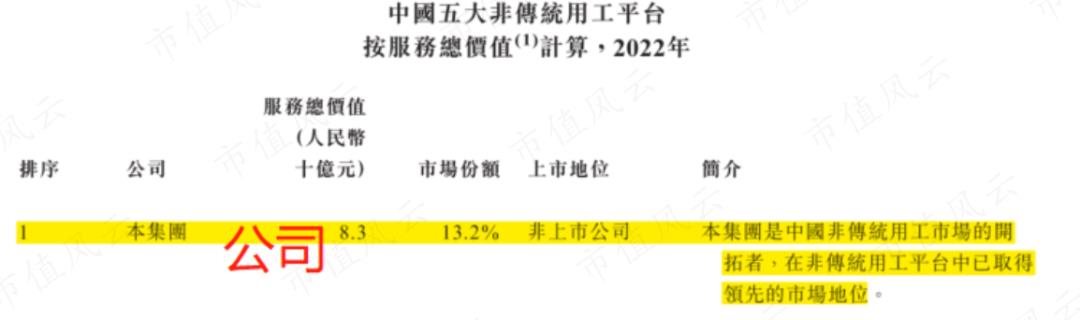

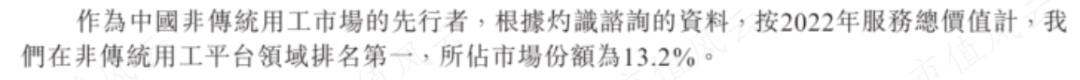

The company is positioned as a "pioneer in China’s non-traditional labor market".

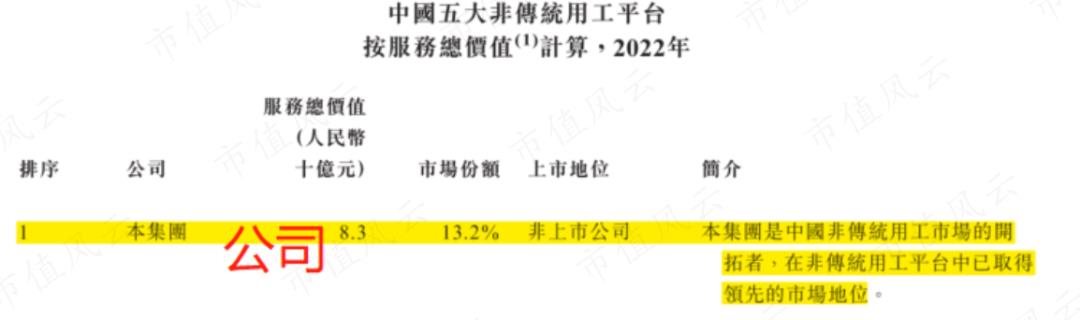

According to Caution Consulting, the company is the leading non-traditional employment platform in China in terms of total service value in 2022, with a market share of 13.2%.

(Source: Company Prospectus)

"Non-traditional employment", which is plainly understood as odd jobs and flexible employment, such as riders, ride-hailing drivers, cleaning and housekeeping.

Non-traditional employment platforms play a role in matching employers and workers. Overseas, representatives of non-traditional employment platforms include Upwork (UPWK. O), Fiverr (FVRR. N), etc.

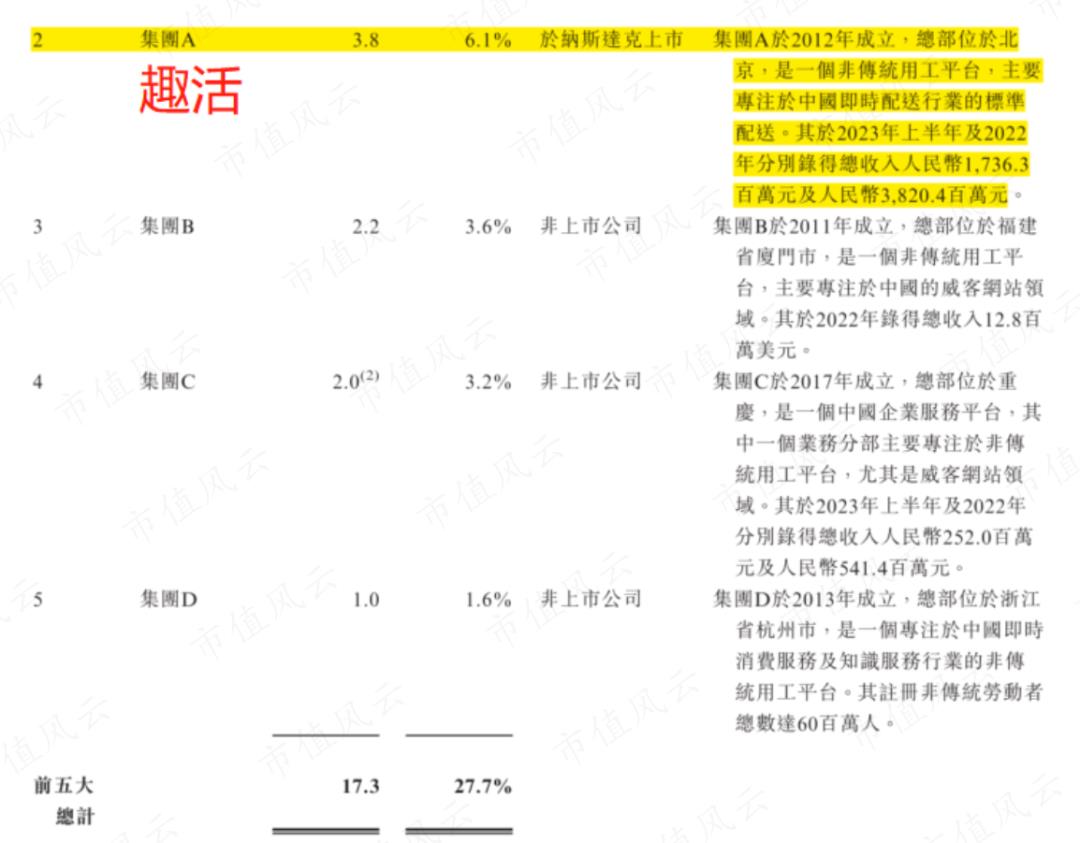

The second largest non-traditional employment platform in China is QH. O, which will be listed on Nasdaq in 2020, with a market share of 6.1%.

(Source: Company Prospectus)

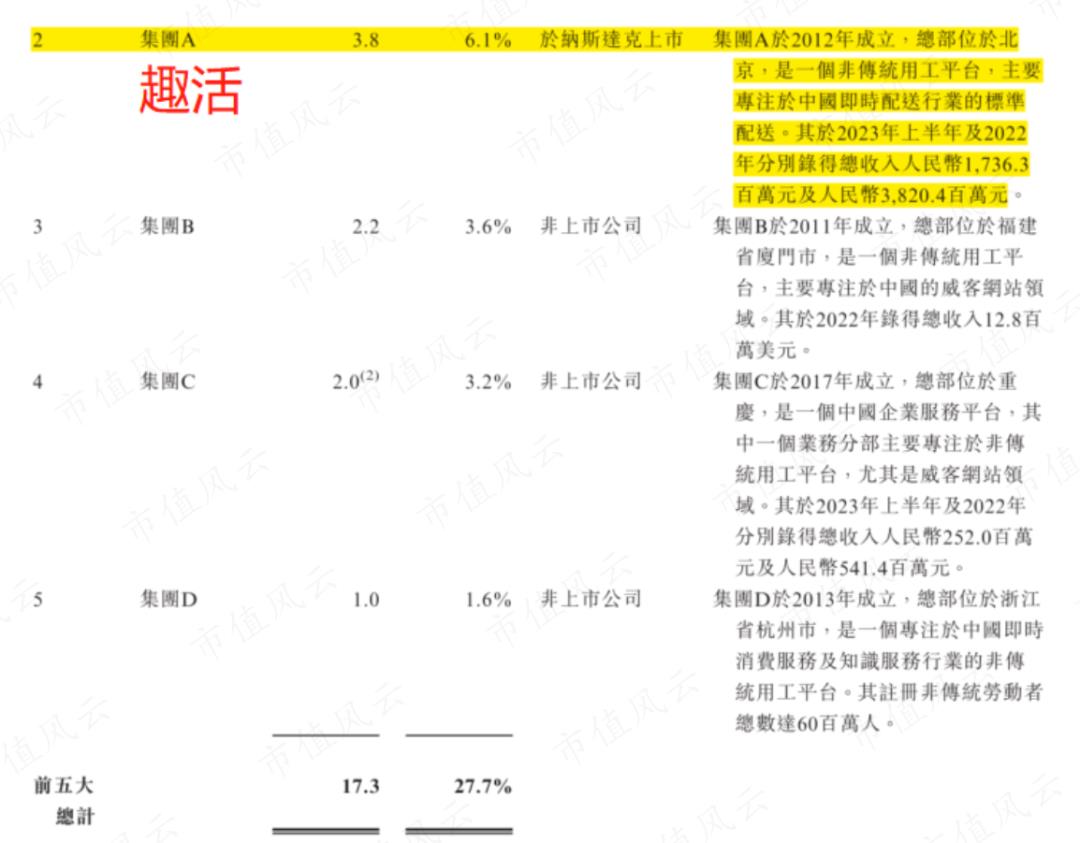

In Fengyunjun’s opinion, the characteristics of domestic non-traditional employment platforms are to focus on serving a small number of Internet Tech Giants.

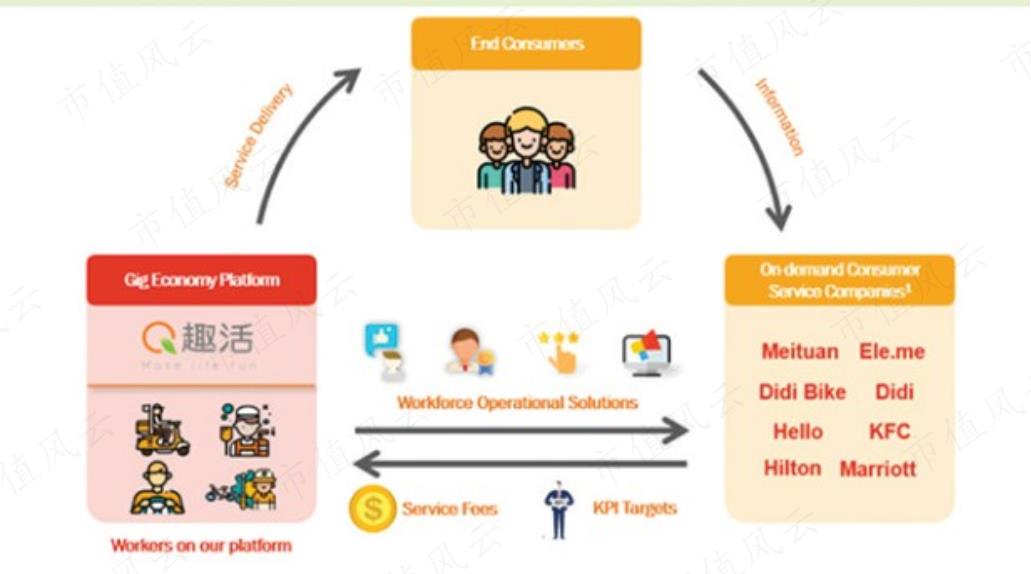

Founded in 2012, Fun Live provides third-party human resources services for Internet platforms such as Meituan, Ele.me, and Didi, including takeaway delivery, ride-hailing driver management, cleaning and housekeeping, and shared bicycle operation and maintenance.

According to Fun Live, from 2021 to 2023, the top three customers, including Meituan and Ele.me, will account for more than 90% of its total revenue.

(Source: Fun Live 2023 Annual Report)

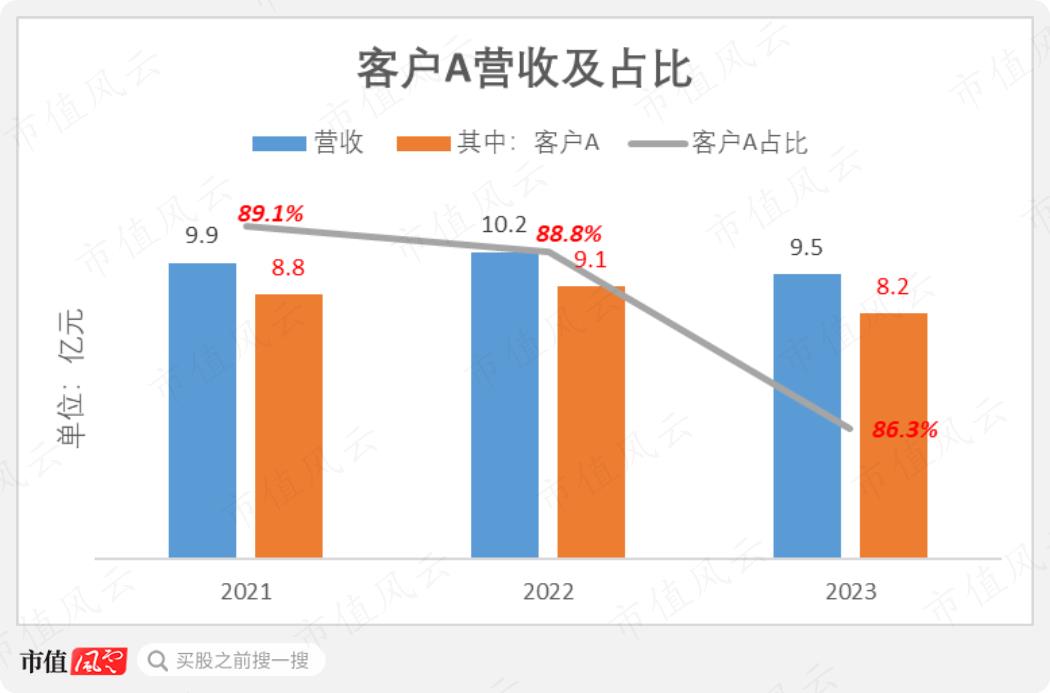

The company’s customer concentration is also extremely high.

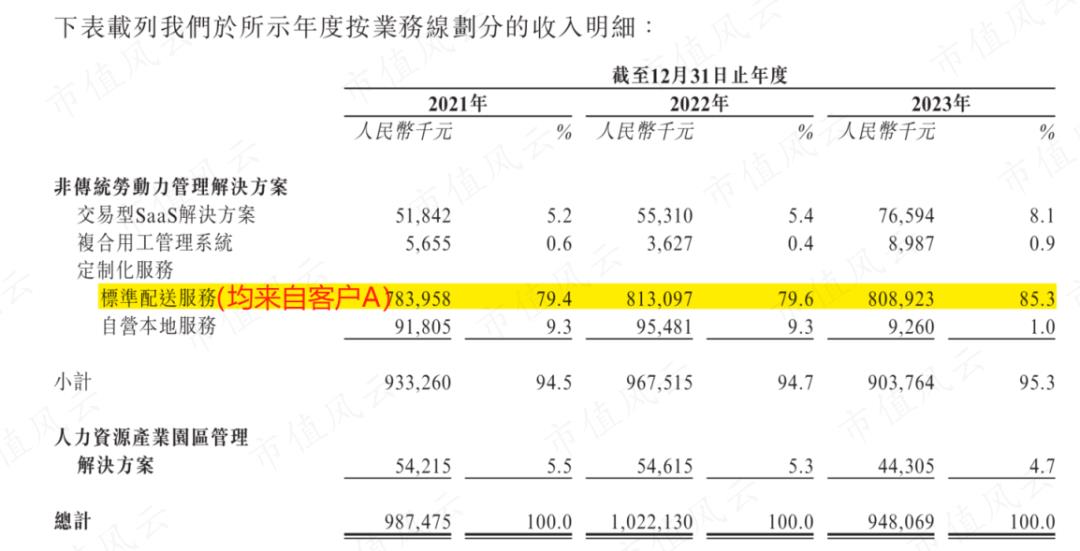

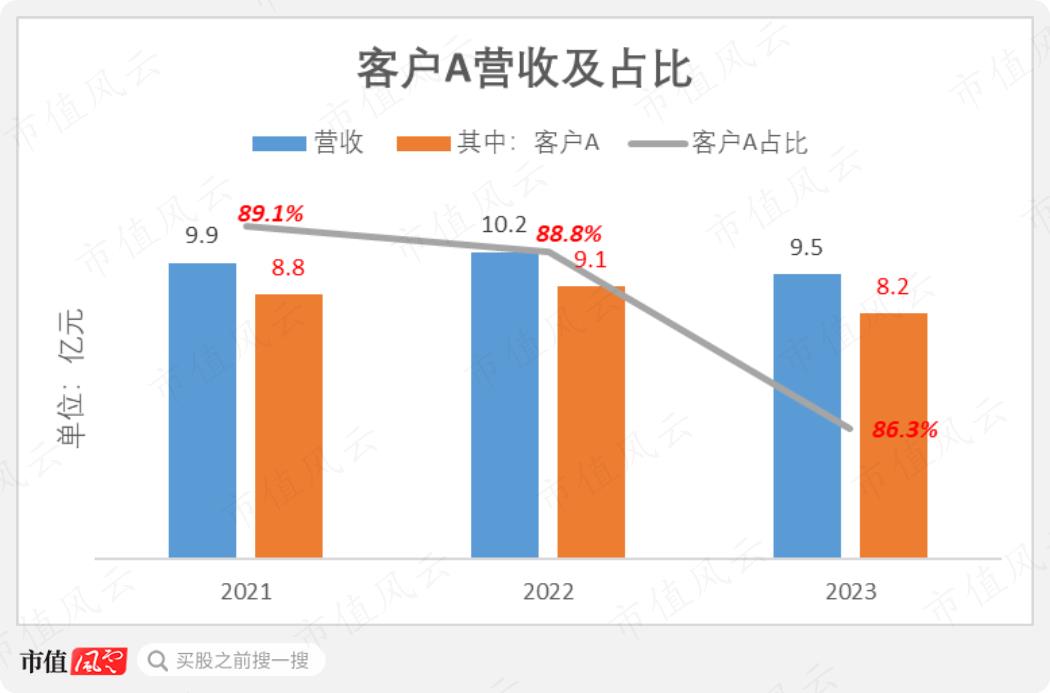

From 2021 to 2023, the company’s revenue scale hovered around 1 billion yuan. During this period, the same largest customer named "Customer A" supported about 90% of the revenue.

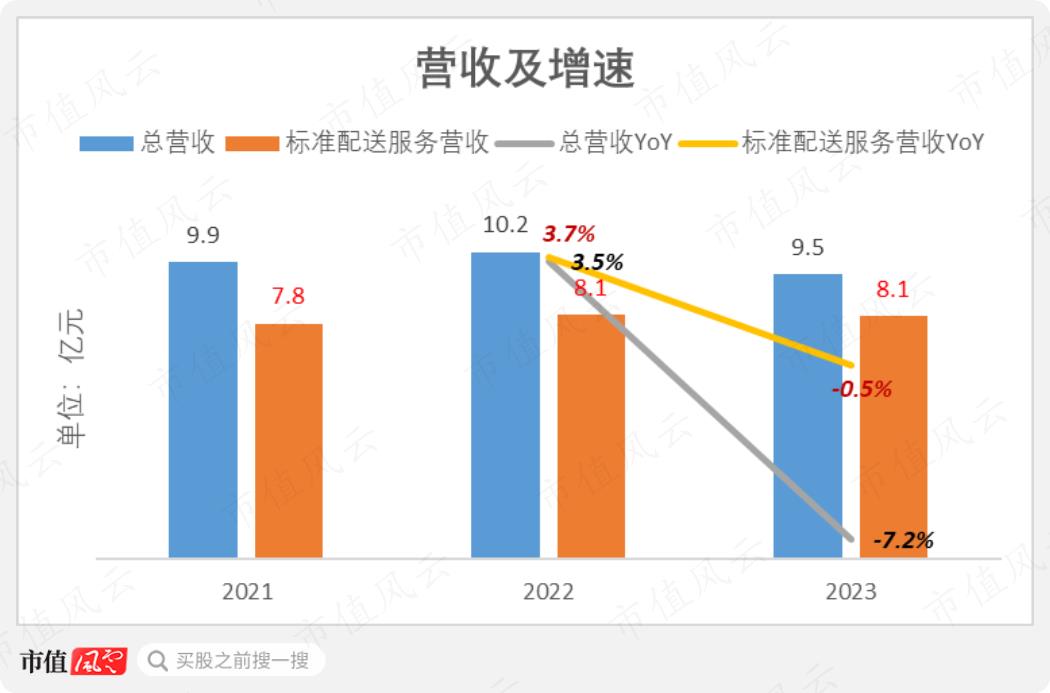

(Drawing: Market Cap Wind and Cloud App)

The company kept the real identity of Customer A secret in its prospectus, saying only that the latter "has a leading market position in China’s instant consumer service industry".

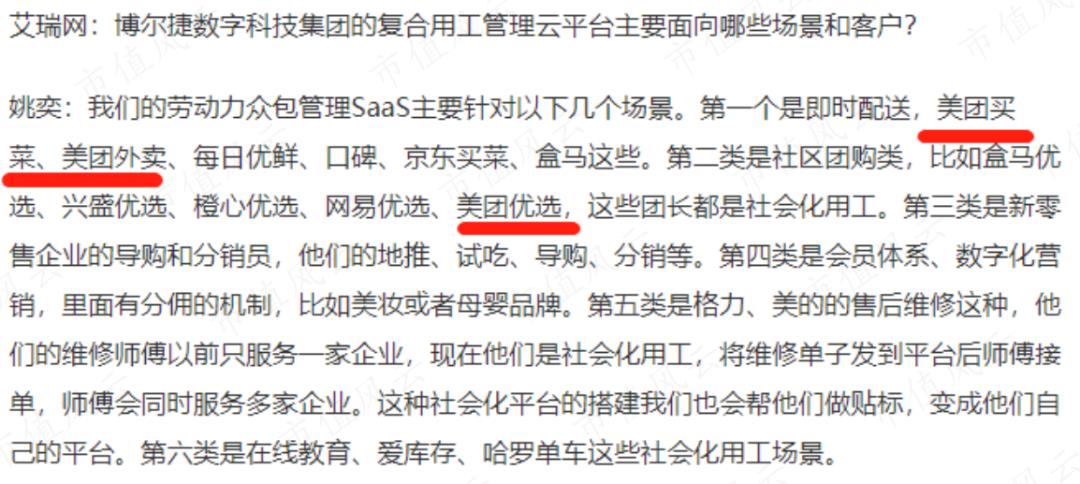

Based on multiple public sources, Feng Yunjun deduced that Meituan was most likely "Customer A".

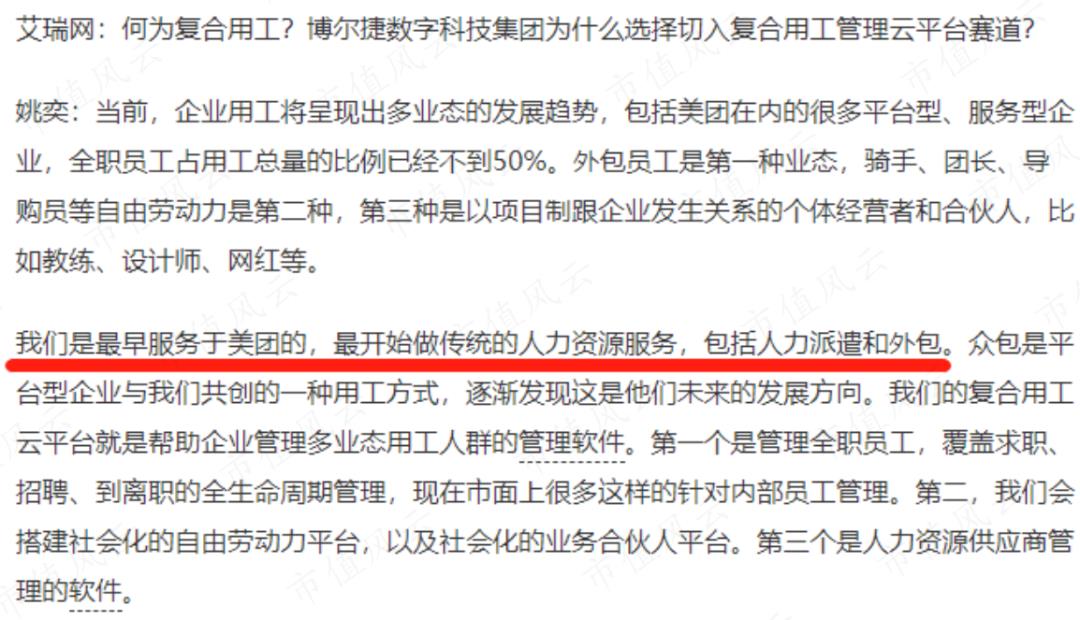

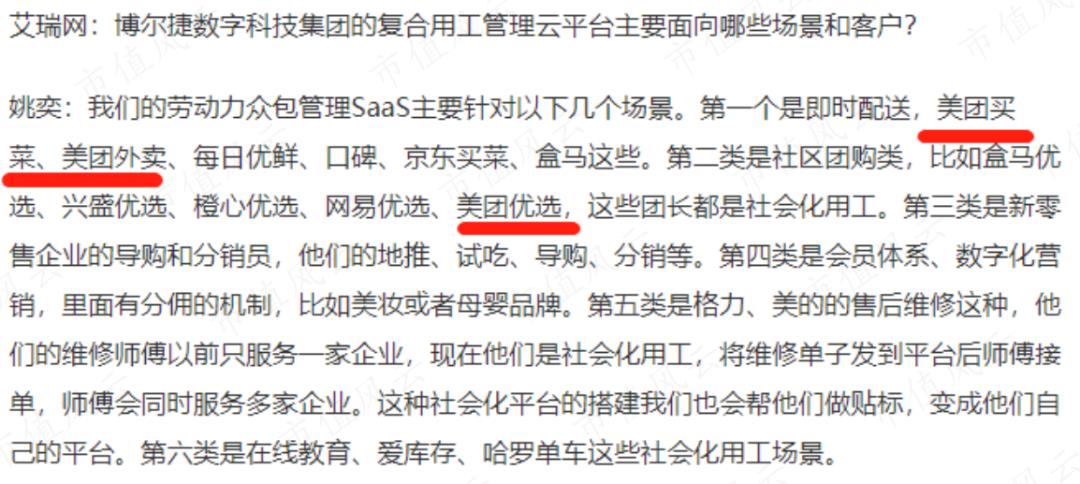

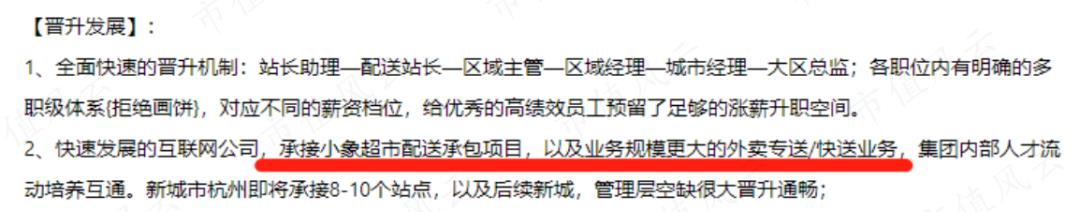

1. Yao Yi, executive director and vice president of the company, said in an interview in August 2021 that the company was "the first to serve Meituan… including manpower dispatch and outsourcing, scene coverage Meituan market (ie" Little Elephant Supermarket "), Meituan takeaway, Meituan Preferred" and so on.

(Source: iResearch)

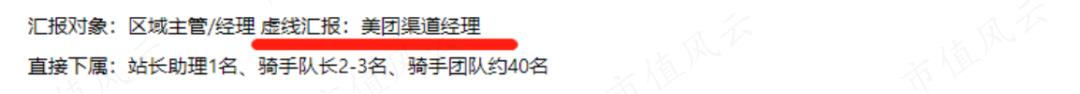

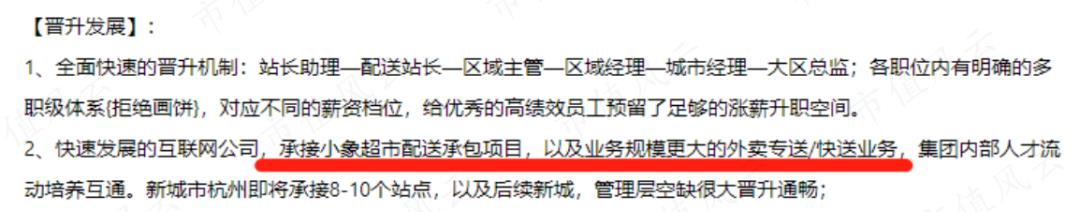

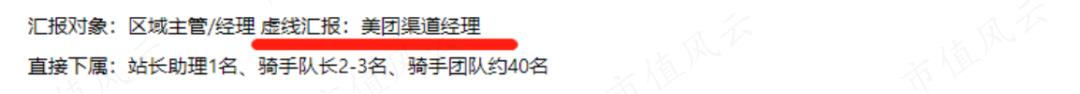

2. According to the third-party recruitment platform, the "distribution webmaster" position recruited by the company is "Meituan channel manager", and the career path includes "undertaking the distribution contracting project of the baby elephant supermarket, as well as the takeaway special delivery/express delivery with a larger business scale".

(Source: Liepin)

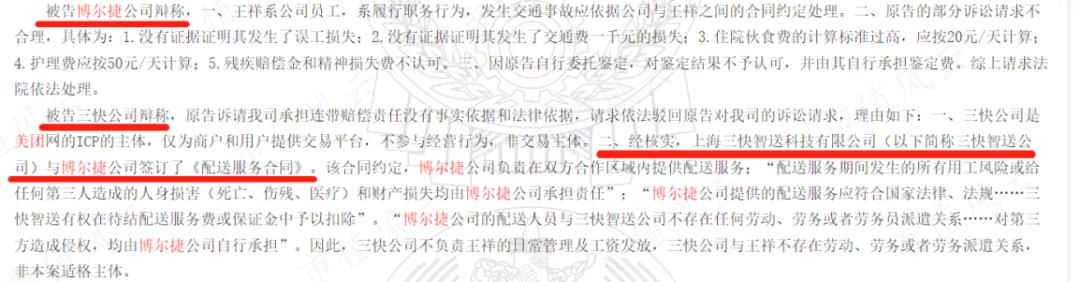

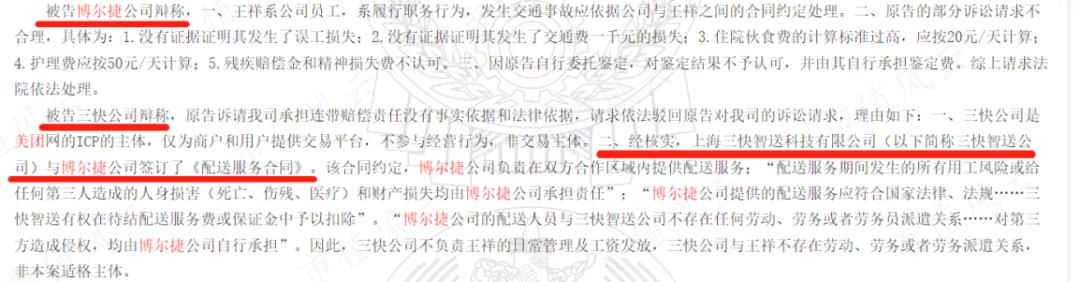

3, China Judgment Document Network shows that for a long time, the company has a number of employment contract disputes and traffic accident liability disputes, Meituan and the company are listed as co-defendants, the court verdict shows that the two sides signed the "distribution cooperation agreement".

(Source: China Judgment Document Network)

Feng Yunjun, who flipped through the information and turned to his dim eyes, couldn’t help but say: Since it is going to be listed, the information disclosure should be open and honest.

For an Internet Tech Giants customer who contributed most of the revenue, was advertised by the company’s management, and almost all people had heard of the name, how did it become mysterious and unspeakable in the company’s prospectus?

The business model and performance are lackluster 01 The main business is Meituan rider outsourcing

The company’s business is divided into two main categories:

(1) Non-traditional labor management solutions: As a non-traditional employment platform, the company provides customers with a package of online and offline services.

(2) Human resources industrial park management solutions: By the end of 2023, the company had operated and managed 16 human resources industrial parks in China.

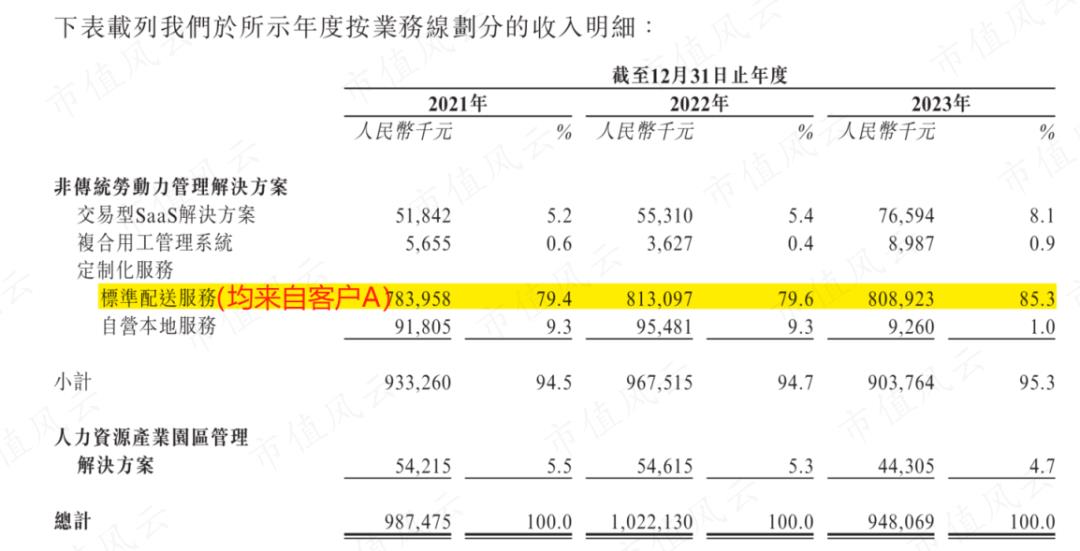

From 2021 to 2023, the revenue share of non-traditional workforce management solutions will remain at 95%, making it a core business.

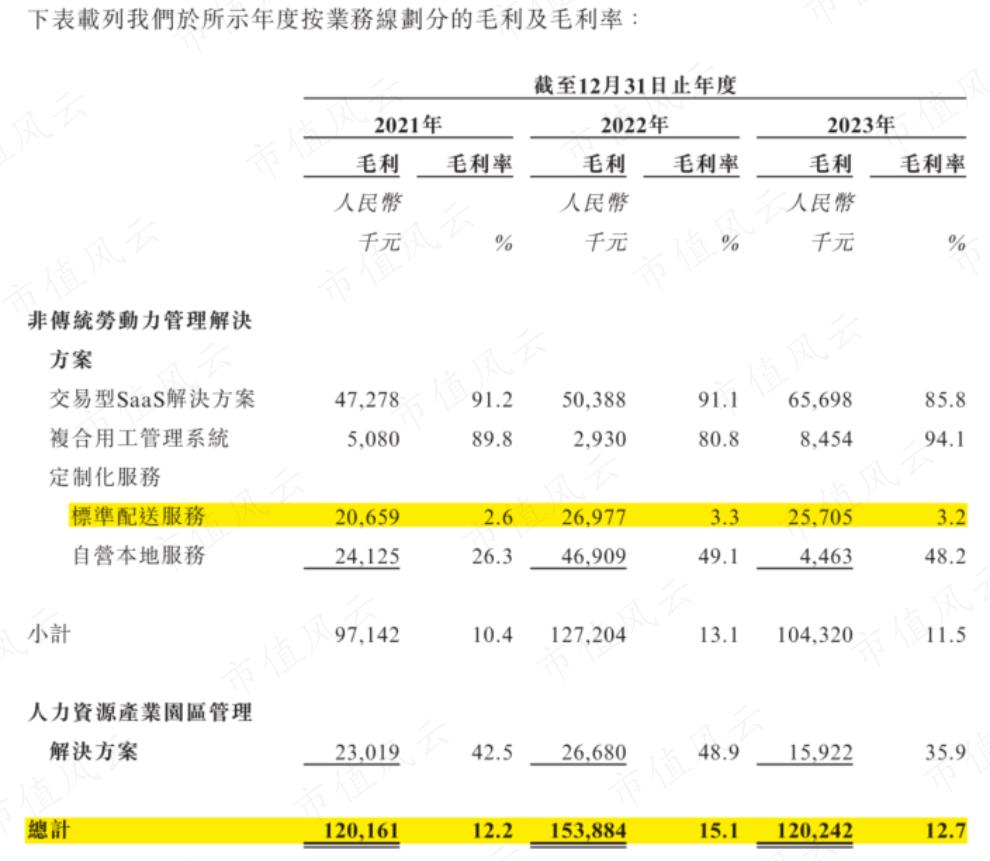

Non-traditional workforce management solutions are further divided into four categories:

(1) Transactional SaaS solutions; (2) Composite employment management systems; (3) Customized services – standard delivery services; (4) Customized services – self-operated local services.

(Source: Company Prospectus)

At first glance, the company’s business is rather complex and confusing.

In fact, the revenue contribution of Meituan, the largest customer, is mainly reflected in "customized service – standard delivery service" ("standard business"), that is, the rider delivery fee paid by Meituan to the company, which is fully recognized as revenue when the order is completed.

In 2023, the company’s total revenue 950 million yuan, of which the standard business revenue 810 million yuan, accounting for 85%.

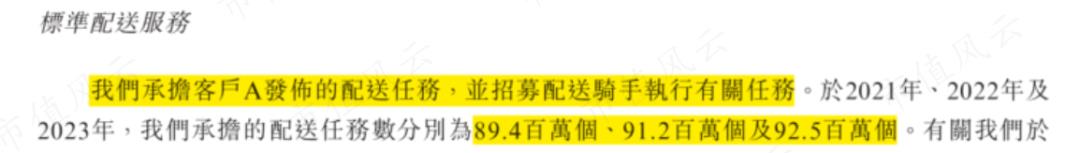

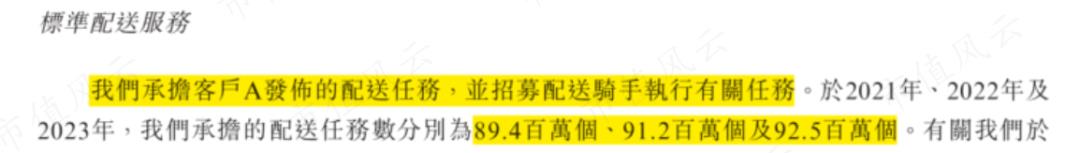

Meituan has brought a huge order volume to the company, increasing from 89.40 million in 2021 to 92.50 million in 2023.

(Source: Company Prospectus)

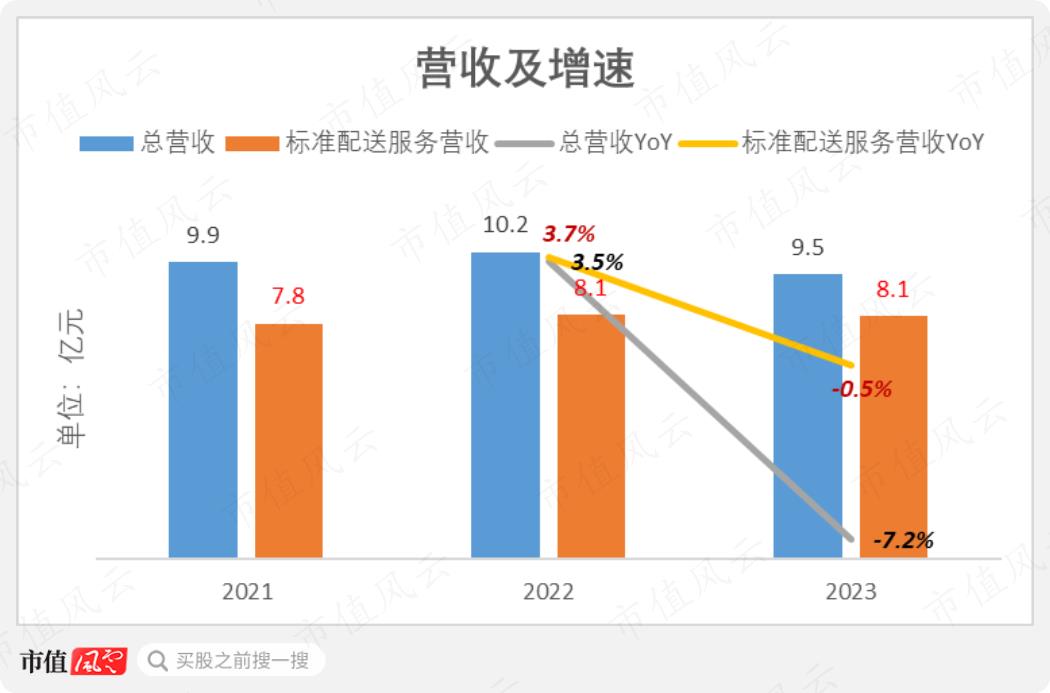

However, compared with the growth rate of order volume and revenue, the company failed to achieve a simultaneous increase in volume and price.

In 2022, the company’s order volume increased by 2.0% year-on-year, driving the standard business revenue and total revenue to increase by 3.7% and 3.5% year-on-year respectively, and it was the best year for performance.

The reason is that in 2022, due to strict epidemic prevention and control measures, the capacity of riders is quite tight. Meituan also said in the financial report of the year that it has increased subsidies for riders.

By 2023, although the order volume will continue to increase by 1.4% year-on-year, the standard business revenue and total revenue will decrease by 0.5% and 7.2% respectively.

(Drawing: Market Cap Wind and Cloud App)

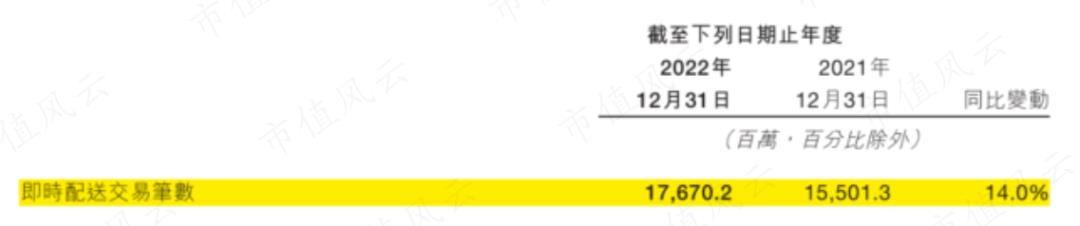

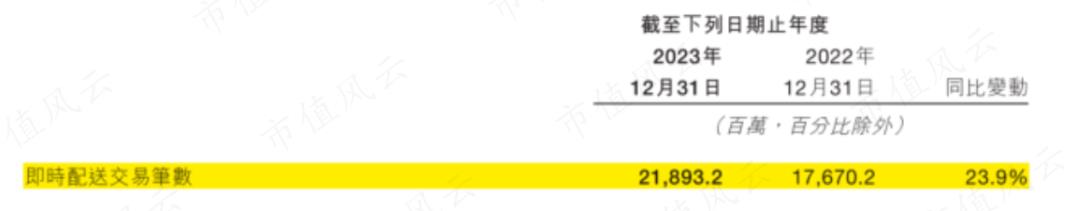

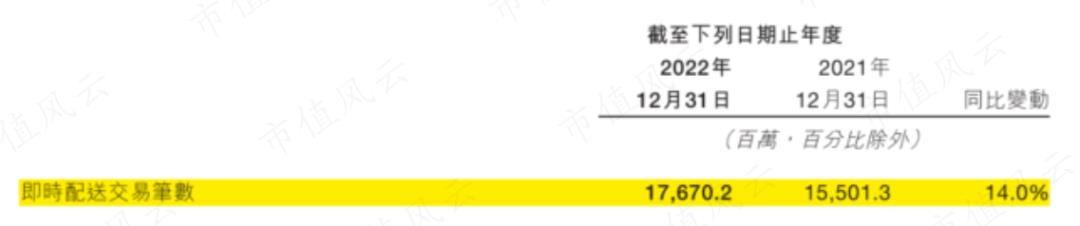

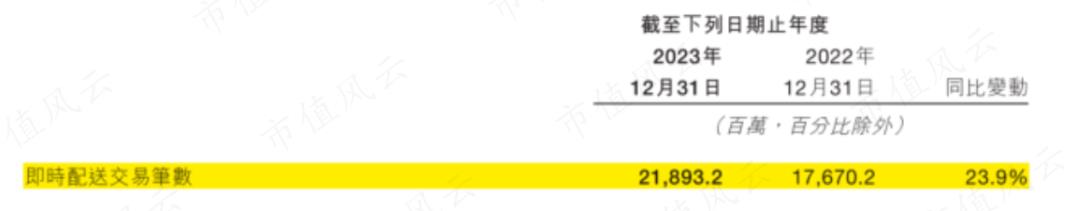

According to Meituan, in 2022 and 2023, Meituan’s ready-to-place orders will increase by 14% and 24% respectively, much higher than the company’s growth rate in the same period.

(Source: Meituan 2023 Annual Report)

Is it because the company’s production capacity cannot keep up with Meituan’s demand, or Meituan doesn’t want the company to be the only one, so the card order volume? This is difficult to evaluate.

However, for Meituan, the company’s fungibility seems rather high.

According to the order volume disclosed by both parties, in 2023, the company will only account for 4.2% of Meituan’s ready-to-distribute orders (Note: 92.5/2189 3.2 * 100%).

02 Core business gross profit is low

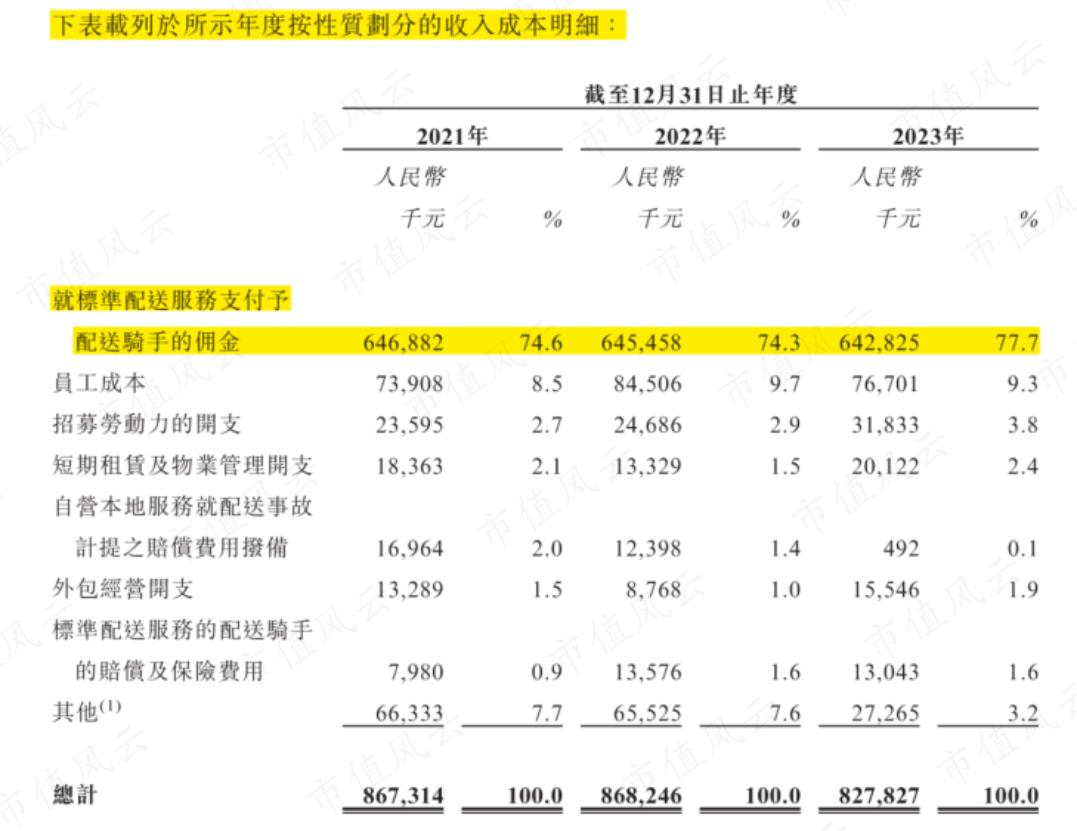

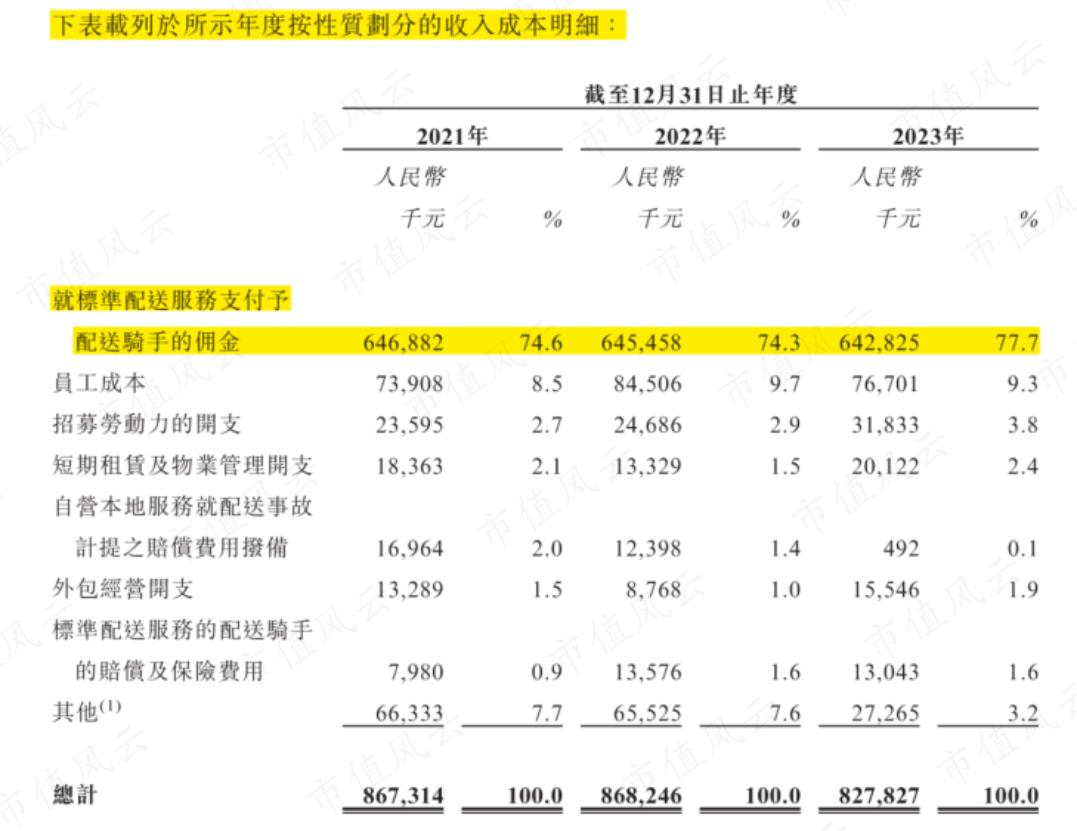

As a contractor, the company is responsible for recruiting a large number of riders, establishing and managing rider sites at its own expense, and paying for rider commissions, distribution site property expenses, rider insurance, and compensation during the period.

Commissions paid to riders constitute the largest expense item for the company’s operating costs, at $640 million in 2023, accounting for 78% of operating costs over the same period.

(Source: Company Prospectus)

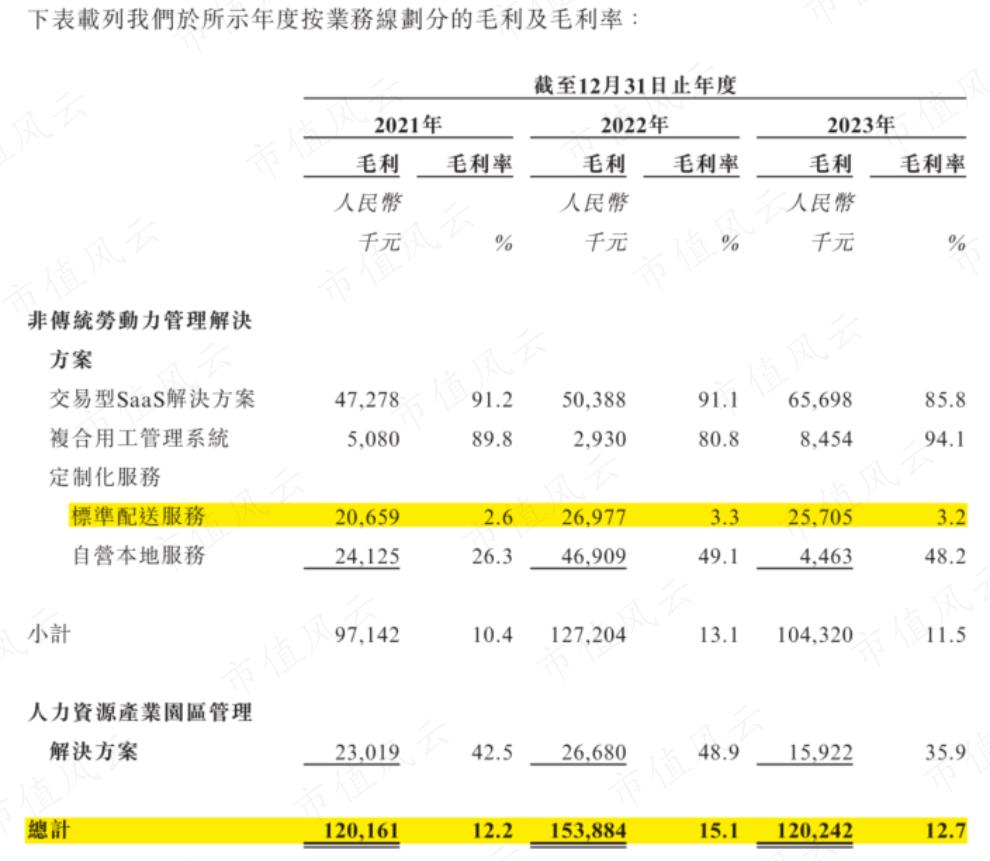

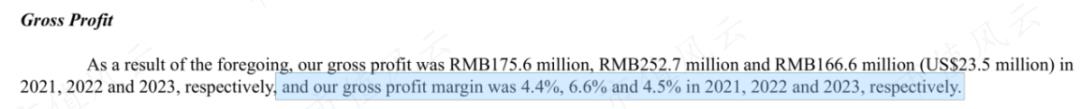

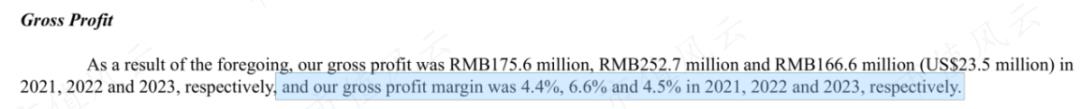

The huge rider commission has resulted in a narrow margin for the company’s standard business. In 2023, the standard business gross margin was 3.2%, lower than the overall gross margin of 12.7% in the same period.

(Source: Company Prospectus)

Then again, low gross margins are a common problem in the entire ready-made outsourcing industry.

The company’s peer competitor, Fun Live, has an overall gross margin of only single-digit percentage, 4.5% in 2023, due to the large proportion of takeaway ready-to-serve business revenue.

(Source: Fun Live 2023 Annual Report)

03 Government subsidies fell sharply

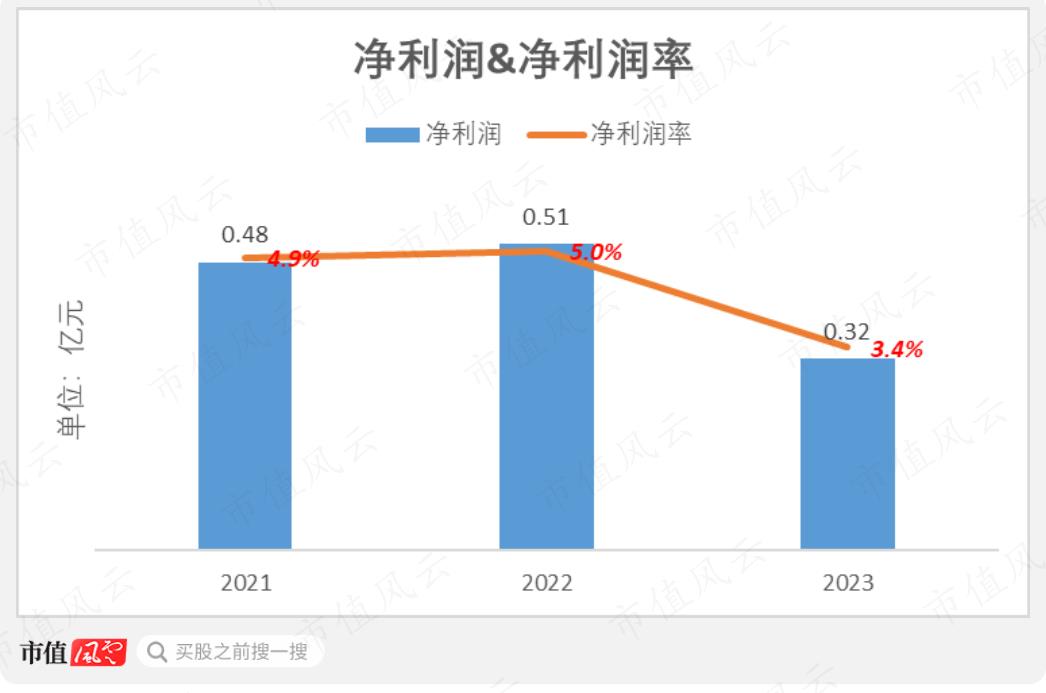

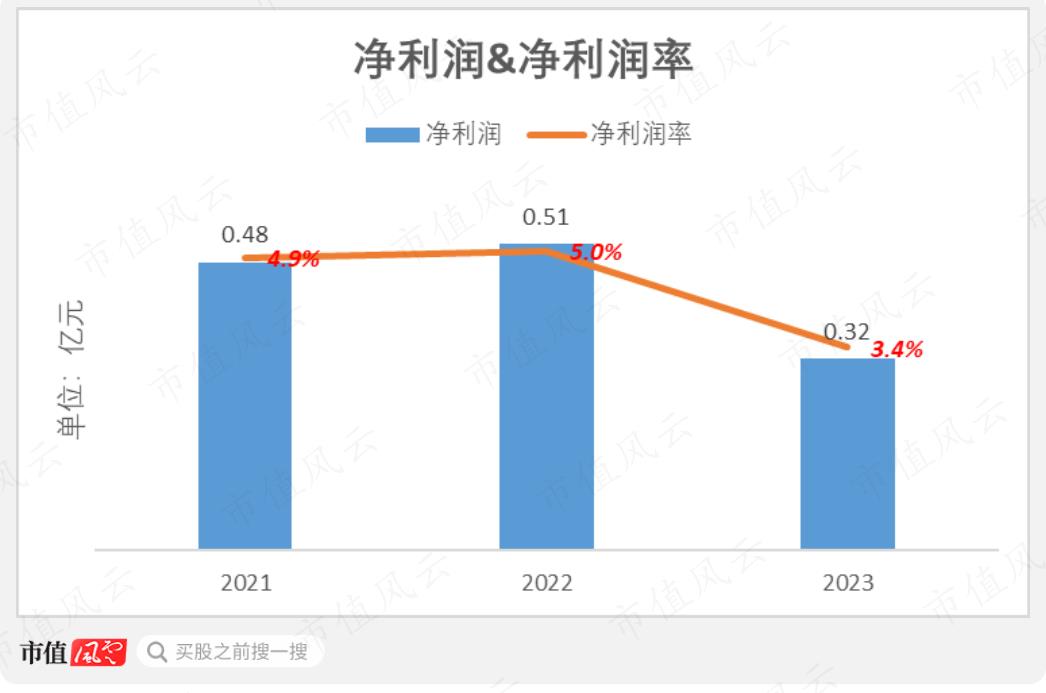

From 2021 to 2022, the company’s annual net profit scale is about 50 million yuan, and the net profit margin is about 5%. In 2023, the company’s net profit has dropped sharply to 32 million yuan, and the net profit margin has dropped to 3.4%.

(Drawing: Market Cap Wind and Cloud App)

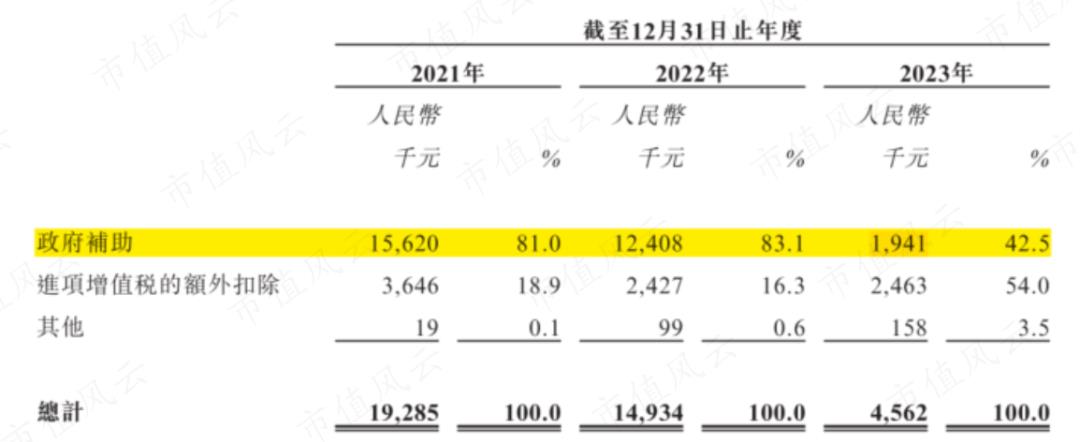

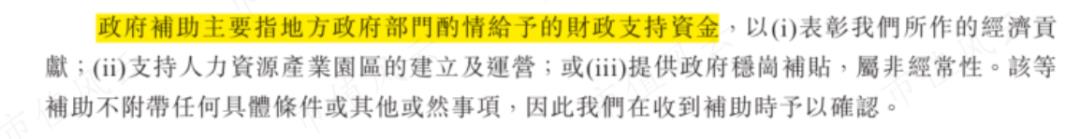

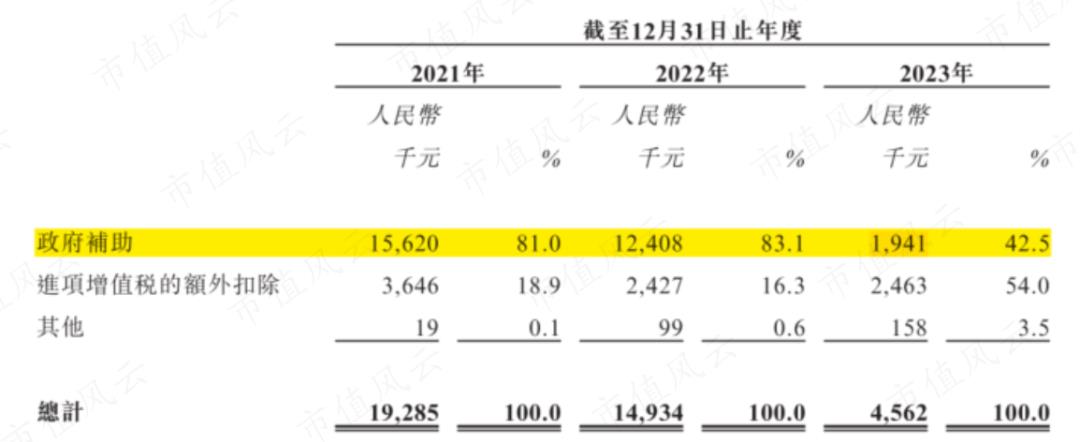

The decline in profitability was mainly due to a significant decrease in government subsidies.

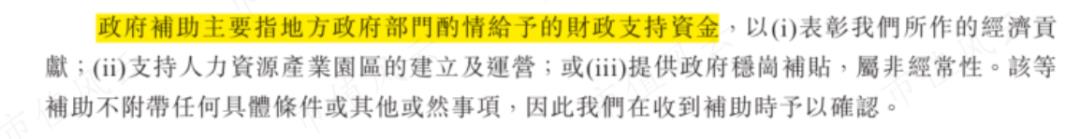

According to the disclosure, the company’s non-core business, Human Resources Industrial Park Management Solutions, can receive financial support funds "at its discretion" from local government departments every year.

(Source: Company Prospectus)

In 2021 and 2022, the government subsidy will be 15.62 million yuan and 12.41 million yuan respectively. In 2023, due to the current situation of local finance, the government subsidy received by the company will be significantly reduced to 1.94 million yuan.

(Source: Company Prospectus)

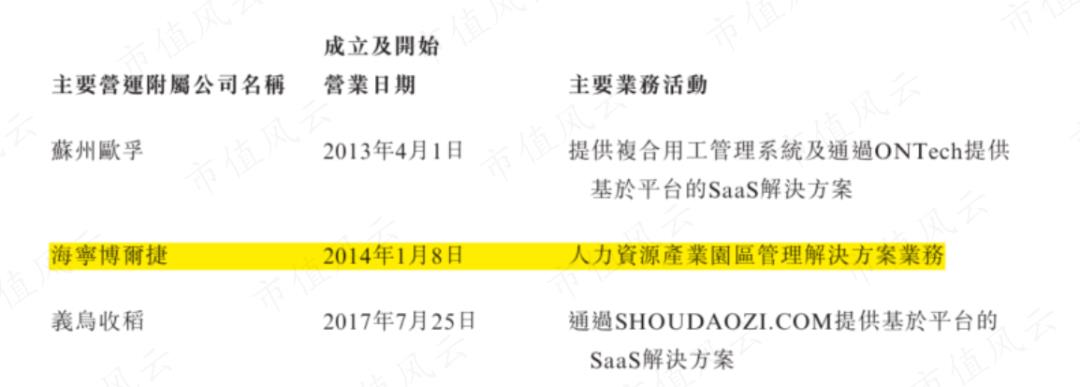

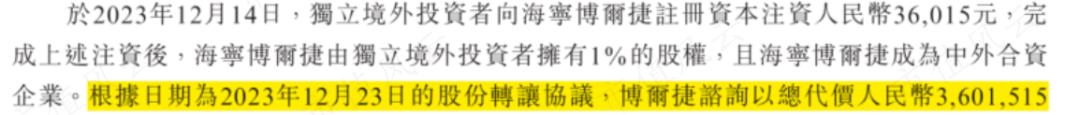

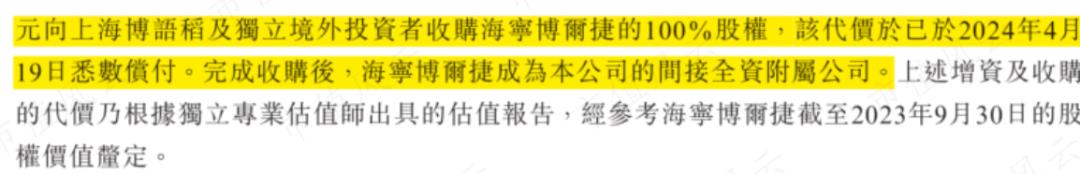

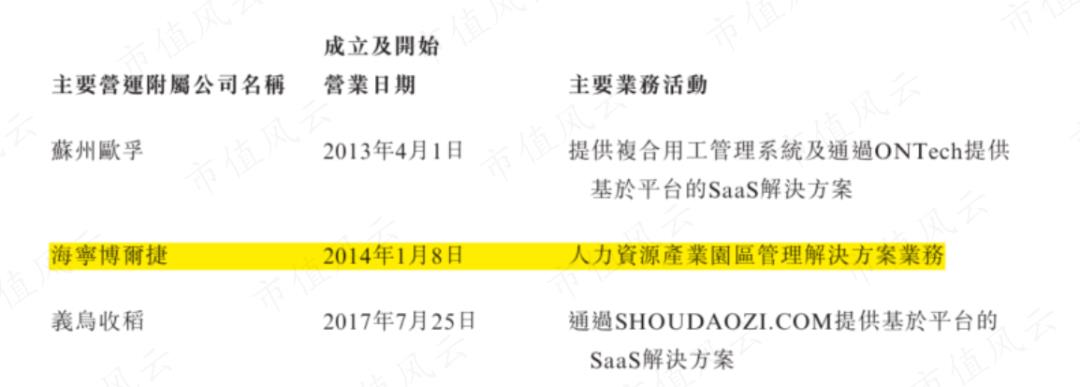

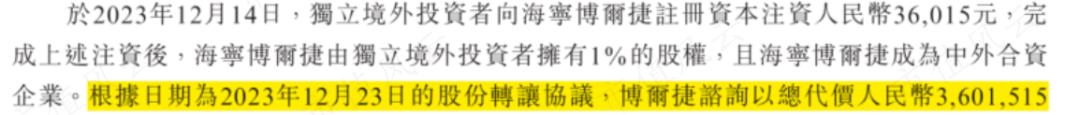

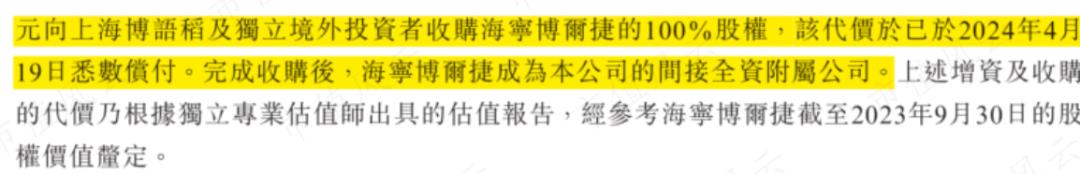

It is worth noting that the non-core business that plays a key role in polishing the company’s income statement was acquired by the company and entered the subject of the proposed listing at a rather clever time.

According to the disclosure, the operating entity of the non-core business is Haining Boltier, and its original controlling shareholder is Shanghai Boyu Rice, which is 100% jointly owned by the company’s five founding shareholders. Therefore, the acquisition is a merger of enterprises under the same control.

(Source: Company Prospectus)

Haining Boltier and the company to be listed were established in 2014 and 2021, respectively.

According to accounting standards, if the parent company is incorporated later than the subsidiary and is under the same control, the consolidated statement should be prepared from the beginning of the earliest comparison period, that is, the subsidiary has been included in the merger since the establishment date.

From 2021 to 2023, Haining Boltier, which was acquired before, paid a total dividend of 44.60 million yuan to the original controlling shareholder Shanghai Boyu Rice, and the acquisition happened to be completed in 2024.

(Source: Company Prospectus)

After the actual controller divides the money, he can put the business into the main body to be listed, and can also beautify the report with past performance. This silky and coherent series of operations is really wonderful!

Fengyun Jun summed up the company in one sentence: lackluster growth and mediocre profitability.

There are many companies involved in human resources outsourcing services in Hong Kong stocks, including Liepin (06100.HK), Manpower (02180.HK), and 06919.HK, all of which are small-cap stocks with a market value of no more than 1.50 billion Hong Kong dollars.

As for the closest thing to the company’s business model, the valuation given by the US stock market is more demanding, and the latter is currently worth less than $6 million.

For companies with such business models, the views of Hong Kong and US stock investors are quite consistent.