The communique of the Central Economic Work Conference has been issued, which has important guidance for the choice of industry structure next year, and scientific and technological innovation has now become the most important support direction of the policy; The opportunities brought by stronger government expenditure are also worthy of attention. Judging from the recent macro-variable changes, the Federal Reserve will become loose next year, and the marginal improvement of external demand is a high probability event; Therefore, the layout of "technological innovation+export" and "technological innovation +To G" has become an important clue to the industry layout next year.

Core view

【 Guance on the Market 】Looking at the industry layout next year from the central economic work conference and macro clues.In 2024, the fiscal expenditure is expected to increase. From the perspective of the Central Economic Work Conference, new industrialization, digital economy and artificial intelligence: among them, the policy expression of artificial intelligence has changed, from safe development to "accelerated promotion". Strategic emerging industries focus on bio-manufacturing, commercial aerospace and low-altitude economy; Expand the scope of local government special bonds used as capital (increase support for "three major projects" and "new urbanization"); It is necessary to promote large-scale equipment renewal and trade-in of consumer goods. Stabilize and expand traditional consumption and boost large-scale consumption of new energy vehicles and electronic products. Generally speaking, TMT, durable consumer goods, machinery and equipment, and some start-up chains are expected to become the directions and fields supported by financial expenditure next year. Recently, a series of statements by the Federal Reserve and the fall of the global inflation center have made it possible for 2024 to become a year of loose global money and liquidity. When the US dollar index weakens and global liquidity tends to be loose, the import growth rate of major countries in the world tends to bottom out and turn positive. Recently, China’s export growth rate has turned positive against the background that the actual base is not low, which also reflects the improvement of China’s export demand. From the direction of global demand improvement next year, semiconductors and consumer electronics, industrial metals, household appliances, automobiles and parts are the areas where domestic and foreign demand has improved marginally in the near future and exports are expected to continue to improve next year.

[Re-examination and Vipassana]The factor affecting that global market this week are as follow:(1) The Central Economic Conference was held in Beijing; (2) The Fed releases dove signals; (3) US CPI in November met expectations; (4) The scale of social financing in China increased by 2.45 trillion yuan in November, 455.6 billion yuan more than the same period of last year; (5) The central bank’s net MLF investment in December reached a new high.

【 meso-prosperity 】In November, the auto market continued to be hot, and the cumulative year-on-year decline in newly started housing area narrowed from January to November.In November, the revenue of most IC manufacturing, memory, silicon wafer, packaging, PCB and passive components in Taiwan stocks decreased year-on-year, while the revenue of IC design, lens, some panels and LED manufacturers achieved positive growth year-on-year. In November, the automobile market continued to be hot, and the production and sales of automobiles increased year-on-year. New energy vehicles and automobile exports led the industry to grow. From January to November, the cumulative year-on-year decline in newly started housing area narrowed, and the cumulative year-on-year increase in completed housing area narrowed; The cumulative year-on-year decline in commercial housing sales and commercial housing sales area has expanded.

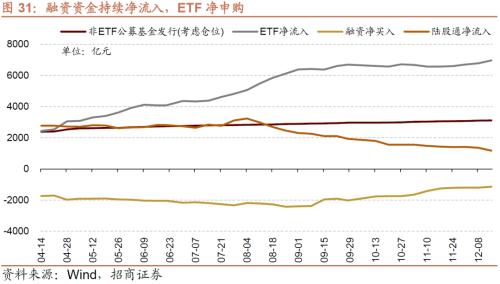

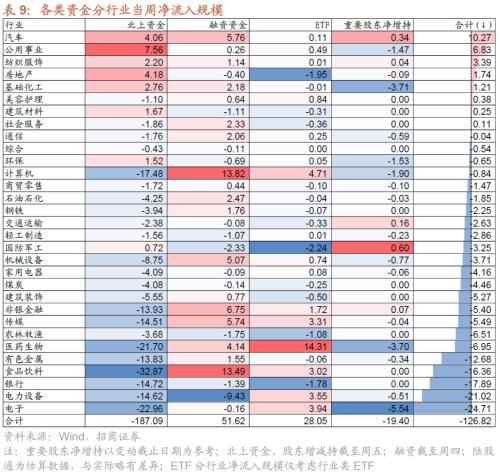

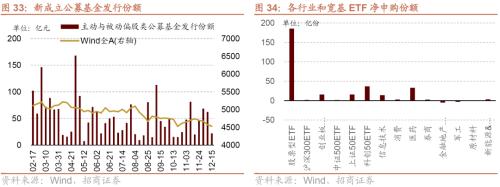

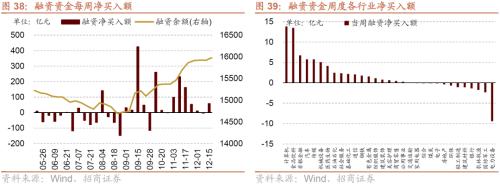

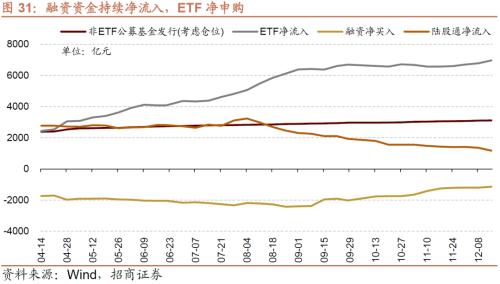

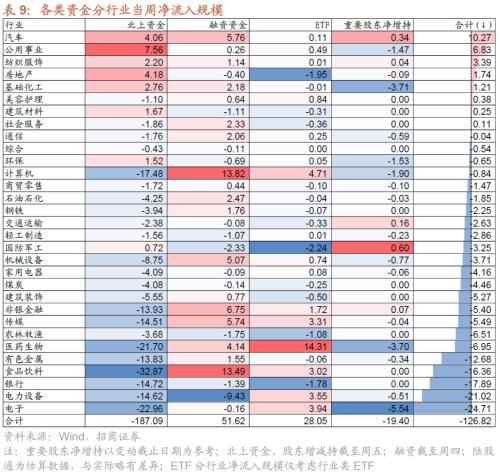

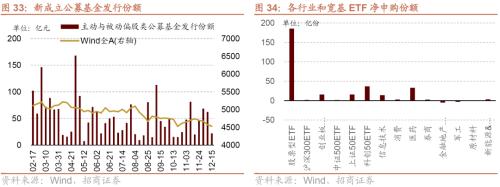

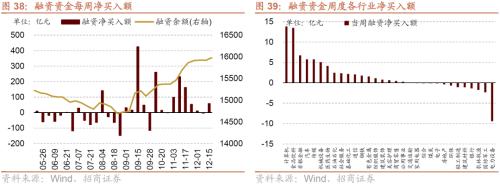

[Capital, Oligopoly]Net inflow of financing funds and net subscription of ETF.The net outflow of northbound funds this week was 18.58 billion yuan; The total net inflow of financing funds in the first four trading days was 5.71 billion yuan; 2.21 billion shares of Public Offering of Fund were newly established, down 4.04 billion shares from the previous period; ETF net subscription, corresponding to a net inflow of 18.39 billion yuan. In terms of industry preference, public utilities, real estate, automobiles, etc. have a higher net purchase scale of funds in the north; Net purchase of financing funds for computers, food and beverage, non-bank finance, etc.; There are more medical ETF subscriptions, and more financial real estate (excluding brokers) ETFs are redeemed. The scale of major shareholders’ net reduction is reduced, and the scale of reduction is planned to increase.

【 Theme and Wind Direction 】With the release of "White Paper on AI PC Industry (China)", Intel launched a brand-new processor, and the AI PC industry accelerated its landing.On December 7th, at the first AI PC Industry Innovation Forum, Lenovo and IDC released the industry’s first White Paper on AI PC Industry (China), which provided a framework for the accelerated development of AI PC. On December 14th, Intel officially launched the AI PC processor at the "AI Everywhere" event held in new york, and the AI PC industry accelerated.

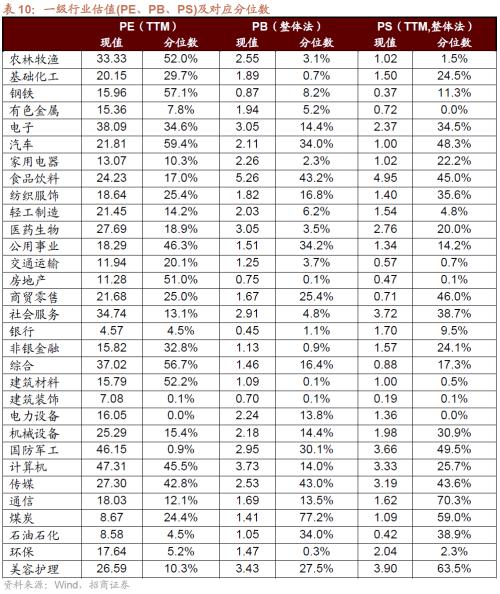

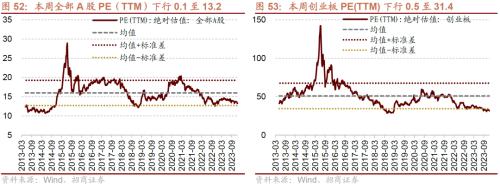

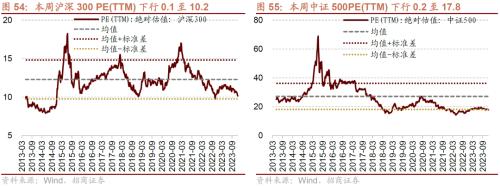

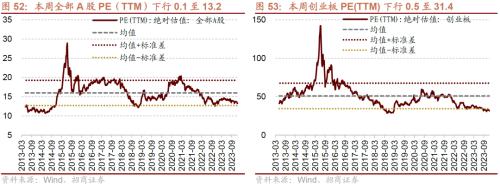

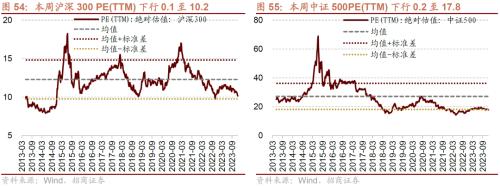

[Data Valuation]The valuation of all A shares this week is lower than last week., PE(TTM) was 13.2, down 0.1 from last week, which was in the 22.4% quantile of historical valuation level. The valuation of the sector is mixed, among which comprehensive, media and social services are among the top gainers, while food and beverage, medical biology and computers are among the top losers.

[Risk warning]Industrial support is less than expected, and the macro economy fluctuates.

01

Viewing policy and discussing the market-Looking at the industry layout next year from the central economic work conference and macro clues

In the strategic outlook for 2024, we believe that with the smooth domestic credit cycle, social financing weakens the profit drive, and different industries enter an era of great differentiation. In 2024, government spending will increase, combined with the improvement of external demand after the end of the global austerity cycle, the domestic economy is expected to recover moderately, global scientific and technological innovation will enter an upward cycle, A-share enterprises will have an upward profit, and the capital will turn to a moderate net inflow. Multi-factor resonance, A-shares are expected to maintain a structural bull trend of upward shock. Structurally, the growth style is relatively dominant, focusing on science and technology, medicine and some cyclical industries with clear industrial trends, large improvement slope of prosperity and good supply and demand pattern of production capacity. At the end of November 2023, we released the report "Turning Point Established, Jedi Counterattacked", arguing that A shares faced ten important positive marginal changes, and the turning point of A shares’ fundamentals, funds and policies was established. At the end of December, 2023, we released the report "Weight Rebound, Growth Across the New Year", arguing that with the convening of the Political Bureau meeting and the Central Economic Work Conference, the adjustment for next year is established, and the measures to stabilize growth are expected to be substantially implemented. The external demand and external liquidity began to improve continuously, and the domestic incremental capital mechanism is constantly emerging. The last N-shaped trend will eventually open after many setbacks.

?Looking at the industry choice next year from the spirit of the Central Economic Work Conference

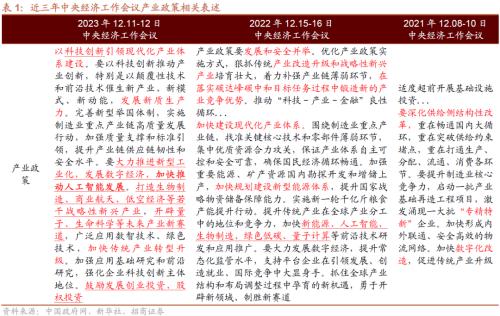

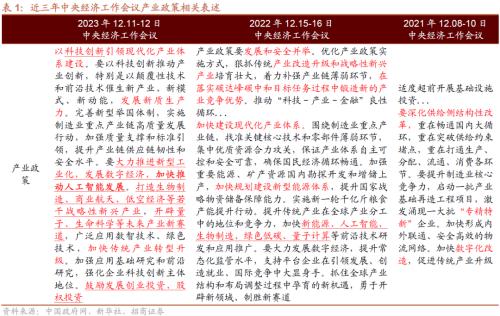

?Industrial Policy: Focus on Four Main Lines of Leading Modern Industrial System Construction with Scientific and Technological Innovation

It is suggested to pay attention to the four main lines of leading the construction of modern industrial system with scientific and technological innovation.This meeting focused on the "self-reliance through science and technology" proposed by the Politburo meeting and further deployed the industrial policy. On December 10th, we published "Under the current valuation level, how to interpret A after the Politburo meeting? It is suggested that the strategic significance of focusing on "self-reliance and self-improvement through science and technology" has been improved again. Judging from the expression of the draft, there are four main lines of industrial policy:

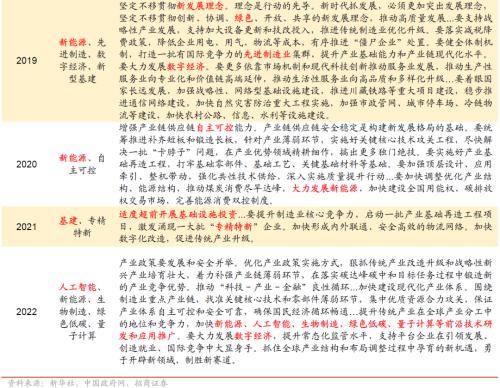

New industrialization, digital economy and artificial intelligence: among them, the policy expression of artificial intelligence has changed, from safe development to "accelerating promotion".In 2022, the Central Economic Work Conference mentioned "artificial intelligence" for the first time. At the Politburo meeting in April this year, high-level officials focused on artificial intelligence for the first time, mentioning "paying attention to the development of general artificial intelligence", but also mentioning "paying attention to preventing risks". In July, the Politburo meeting once again mentioned "artificial intelligence", continued the idea of safe development, and pointed out "promoting the safe development of artificial intelligence". However, the evolution of the expression of artificial intelligence in this Central Economic Work Conference is to "accelerate the promotion", and the high-level attention to artificial intelligence needs no elaboration.

Strategic emerging industries: bio-manufacturing, commercial aerospace and low-altitude economy.

Future industries: quantum and life sciences

Industrial transformation and upgrading: digital intelligence technology and green technology

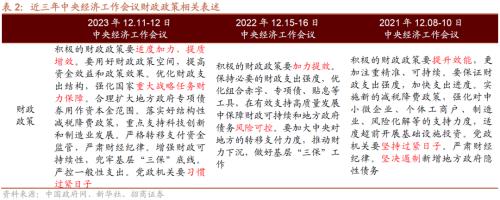

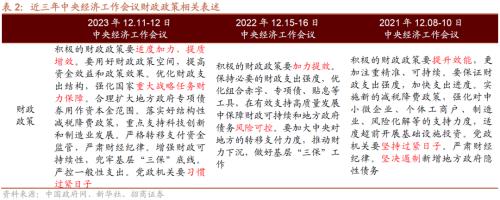

?Fiscal policy: the policy will make moderate efforts to support key areas such as scientific and technological innovation, and wait for the start of a new round of fiscal and taxation system reform.

Focus on supporting scientific and technological innovation and manufacturing development, and financial support for "three major projects" and "new urbanization" is expected to increase.After the expression of fiscal policy was expanded from "increasing strength and improving efficiency" to "moderately increasing strength, improving quality and increasing efficiency" at the Politburo meeting in December, this meeting further pointed out the specific direction of increasing strength and increasing efficiency. Specifically, the follow-up will 1) focus on increasing financial support for major national strategic tasks.(Provide more subsidies and increase tax cuts for technological innovation and manufacturing development); 2) Expand the scope of local government special bonds as capital.(Increase support for "three major projects" and "new urbanization").

Plan a new round of fiscal and taxation system reform.After a lapse of three years, the Central Economic Work Conference once again mentioned "the reform of fiscal and taxation system", and the last time it mentioned "the reform of fiscal and taxation system" was at the Central Economic Work Conference in 2019. In the future, the further thinking and deployment of the fiscal and taxation system reform are expected to be further elaborated at the important meeting to be held next year. The focus of the reform may continue to "establish a central and local financial relationship with clear rights and responsibilities, coordinated financial resources and regional balance" mentioned in the 14 th Five-Year Plan.Mainly focus on the financial relationship between the central and local governments.

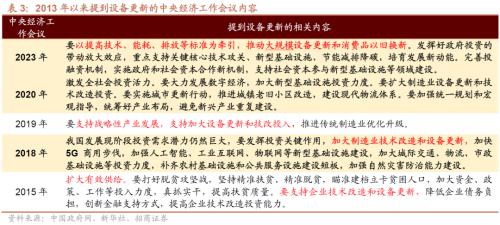

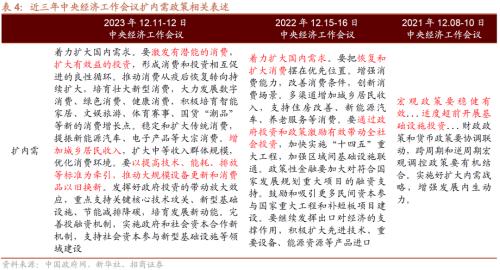

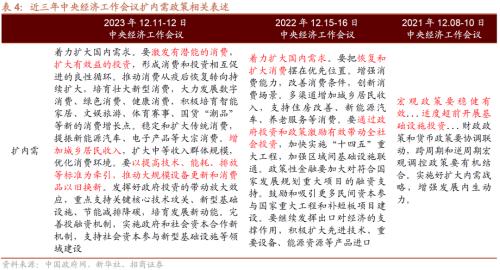

?The policy of expanding domestic demand: renewal becomes the starting point of investment, paying attention to the trade-in of consumer goods.

Update as the main starting point of investment.The meeting continued the tone of the Politburo meeting, affirmed that insufficient demand is still the main contradiction restricting China’s economic development, and further expounded how to form a "virtuous circle of mutual promotion of consumption and investment."

In terms of consumption, in addition to increasing consumer supply,Cultivate new consumption(digital consumption, green consumption, healthy consumption, actively cultivating smart homes, recreational tourism, sports events, domestic products "trendy products", etc.),Stabilize traditional consumption(Boosting the mass consumption of new energy vehicles and electronic products), the meeting further affirmed the need to "increase the income of urban and rural residents and expand the scale of middle-income groups", andTrade-in of consumer goods.

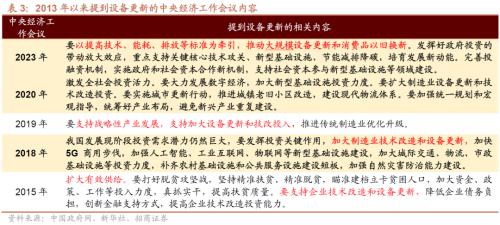

On the investment side, the meeting made it clear that updating should be the key breakthrough point.It is proposed to "promote large-scale equipment renewal and trade-in of consumer goods". China once mentioned equipment renewal in the central economic work conferences in 2015, 2018, 2019 and 2020, but only in the conferences in 2018 and 2020, equipment renewal was regarded as the starting point of investment.Among them, although the meeting in 2018 will give priority to supporting technological transformation and equipment renewal in the manufacturing industry, it will focus on the new infrastructure, and the new infrastructure has developed rapidly since then. This meeting focused on the equipment renewal in detail, and put forward the idea of "improving technology, energy consumption, emission and other standards as the traction" and used the word "large-scale", which showed a strong policy appeal to promote equipment renewal.In the future, or referring to the policy context of new infrastructure, there will be more policy documents to further define the standards and measures for equipment renewal.From the perspective of specific policy expectations, the special refinancing of equipment renovation and other structural support tools that were introduced in 2022 are expected to be introduced.

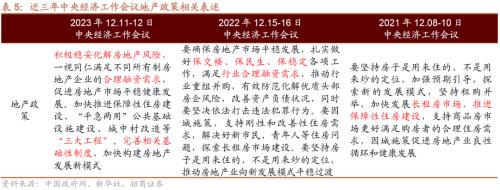

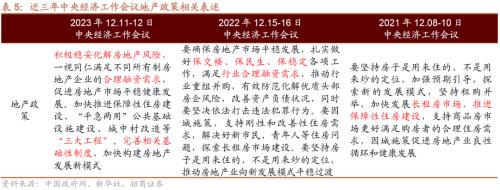

?Real estate policy: continuing the previous policy context

This meeting continues the previous policy context.: 1) Continue to "actively and steadily resolve real estate risks"; 2) Continue to "protect the main body" and "meet the reasonable financing needs of real estate enterprises with different ownership equally"; 3) Continue to "accelerate the construction of affordable housing, the construction of public infrastructure for both ordinary and emergency use, and the renovation of villages in cities".However, it is worth noting that under the background that the Politburo meeting in December and this Central Economic Work Conference all mentioned "first set up and then break", the intensity of various real estate policies is expected to increase.

Based on the policy adjustment and various economic work arrangements of the Central Economic Work Conference in 2023, we believe that the investment guidelines of the Central Economic Work Conference for A shares next year mainly include the following aspects:

(1) From a macro perspective, the strength of policy support for various economic work is expected to exceed market expectations.Specifically, the fiscal policy orientation is positive, and deficit ratio will arrange or keep it above 3%, but it will not be flooded.; Monetary policy is flexible, moderate, accurate and effective. It is mentioned for the first time that "money supply" matches "expected target of price level", and there may be room for further interest rate reduction in the first quarter of next year.Liquidity is expected to be further relaxed, bringing room for valuation improvement for A shares;

(2) From the perspective of industry, focus on the industrial policy force brought by the new wave of scientific and technological revolution, and grasp the four main lines of science and technology and the new quality productivity.In Report to the 20th CPC National Congress, "self-reliance through science and technology" was emphasized. This meeting put "leading the construction of modern industrial system with scientific and technological innovation" at the top of all key work arrangements in the coming year, and the importance of self-reliance and self-reliance in science and technology is beyond doubt. This meeting highlightedFour main lines: 1) new industrialization, digital economy and artificial intelligence; 2) Strategic emerging industries: bio-manufacturing, commercial aerospace and low-altitude economy; 3) Future industries: quantum and life sciences; 4) Industrial transformation and upgrading: digital intelligence technology and green technology, and re-emphasized the "new quality productivity" first mentioned by the Supreme Leader General Secretary in September this year.

(3) From the perspective of industry, focus on the investment with equipment renewal as the main starting point, and the consumption policy of trade-in of consumer goods/new consumption/bulk consumption.This meeting not only continued the tone of the previous Politburo meeting on the mutual promotion of consumption and investment, but also proposed to focus on equipment renewal in investment.And for the first time, it focuses on the main direction of equipment renewal, and even uses "large-scale" to imply a strong policy appeal of taking equipment renewal as the investment grasper.Subsequent supporting policies, such as special refinancing for equipment renewal, are expected to be further introduced.The growth rate of manufacturing investment is expected to remain high next year, and a new round of equipment renewal cycle is expected to come under the impetus of policies.In addition, on the consumer side, the policy mainly focuses on cultivation.New consumption (smart home, entertainment consumption, domestic products) and stable traditional consumption (new energy vehicles, consumer electronics) are recommended to continue to pay attention. In addition, the trade-in of consumer goods and the silver-haired economy are also expected to become the main scenes of consumption.

(4) From the perspective of industry, it is suggested to pay attention to the silver-haired economy, new urbanization/urban renewal, which has the potential to evolve into an important main line in the future.Combing all previous central economic work conferences since 2013,This meeting put forward the concept of "silver hair economy" for the first time.However, the specific policy deployment needs to be further launched, and it is expected to become the main line of market interpretation in the future. In addition, this meeting once again mentionedNew urbanization and urban renewalAlthough they are not placed in the paragraph of expanding domestic demand and promoting investment in length, it does not rule out that they will become the main focus of investment, and it is recommended to pay attention to the follow-up policy direction.

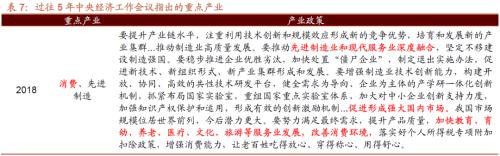

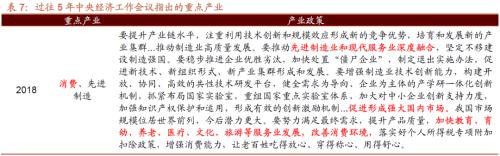

Looking back on the past five years, the Central Economic Work Conference has great guidance for the performance of the A-share industry in the coming year. Consumption in 2019 (food and beverage, household appliances, etc.); Electric innovation in 2020 and 2021 (electric equipment and automobiles), infrastructure (transportation and construction) in 2022, and artificial intelligence (communication, media, computer and electronics) this year.To sum up, after summarizing the central economic work, we suggest focusing on: 1) main lines of science and technology (four main lines and new quality productivity), 2) equipment renewal, 3) trade-in of consumer goods/new consumption/bulk consumption, 4) silver-haired economy, and 5) new urbanization/urban renewal.

?Two clues of recent macro-changes

?Clue 1: fiscal expenditure is expected to increase in 2024, and the direction of government expenditure is worthy of attention.

Judging from the spirit of the Central Economic Work Conference, the expression of fiscal policy has been expanded from "enhancing efficiency through efforts" to "moderately enhancing efforts, improving quality and increasing efficiency". In 2024, with the local government debt problem beginning to resolve and economic growth facing new pressure, government expenditure has started to accelerate obviously in the near future. It is expected that the expenditure intensity will be maintained in 2024, and finding the direction of government expenditure is an important idea for industry selection in 2024.

1) Focus on increasing financial support for major national strategic tasks (providing more subsidies and increasing tax reduction for scientific and technological innovation and manufacturing development); 2) Expand the scope of local government special bonds as capital (increase support for "three major projects" and "new urbanization"); 3) We should take the improvement of technology, energy consumption, emission and other standards as the traction to promote large-scale equipment renewal and trade-in of consumer goods. 4) Stabilize and expand traditional consumption, and boost mass consumption of new energy vehicles and electronic products.

The industries involved in the above policies include household appliances, household appliances, new energy vehicles, electronic products and other durable goods; The construction chain includes building materials and industrial metals; TMT in the field of science and technology.

?Clue 2: The global monetary policy environment is becoming loose, the global import growth rate is expected to bottom out and China’s external demand will improve.

In 2023, under the global monetary and liquidity tightening environment, the global import growth rate showed a significant decline. China’s exports are also under certain pressure, with a negative growth rate in many months throughout the year. Recently, a series of statements by the Federal Reserve and the fall of the global inflation center have made it possible for 2024 to become a year of loose global money and liquidity. Recently, the US dollar index has also weakened significantly, reflecting the market expectation. In the past historical samples, when the US dollar index weakened and global liquidity became loose, the import growth rate of major countries in the world often bottomed out and turned positive.

Judging from the recent import amount and growth rate of representative countries in the world, the import amount of representative countries in the world improved slightly in November, and the growth rate rebounded slightly.

China’s exports turned positive in November. In fact, the base in November last year was not low, indicating that China’s exports began to improve; At the same time, the export growth rate of export-oriented countries represented by India, Thailand, Vietnam and South Korea has also turned positive since October.

On the whole, finding the direction of improving global demand and marginal improvement of China’s export growth rate has become an important idea for choosing industries in the first half of 2024.

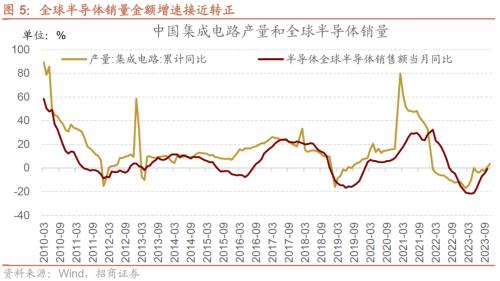

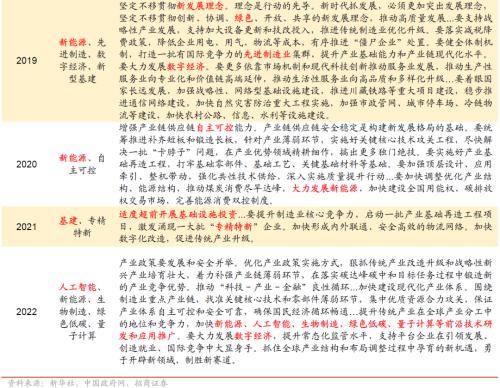

Semiconductors and consumer electronics

Semiconductors and consumer electronics are typical global demand industries. Judging from the growth rate of global semiconductor sales in October, global semiconductor sales are close to turning positive. Due to the low base this year, the current innovation trend represented by artificial intelligence is in the ascendant. It is a high probability that the global semiconductor growth rate will turn into double-digit positive growth in 2024.

Consumer electronics, represented by mobile phones, has also begun to pick up in the near future, and global smartphone shipments have nearly turned positive year-on-year in the third quarter. With the progress of artificial intelligence technology and the marginal improvement of external demand, it is expected that the global shipments of smartphones and other consumer electronics will turn positive in 2024.

As China is the largest mobile phone manufacturer, in the context of marginal improvement in demand for smart phones in China and the world. At present, the growth rate of mobile phone production in China has returned to a higher level.

Due to the obvious increase in the demand for computing power in the current artificial intelligence model, the hardware innovation trend based on the artificial intelligence model is expected to come next year. For example, AI mobile phone AI PC and other innovative hardware based on artificial intelligence are expected to launch and superimpose XR equipment represented by MR next year. It is also expected to start to increase shipments, and the semiconductor and consumer electronics fields are very in line with the comprehensive logic of domestic policy support, technological innovation trend and external demand improvement.

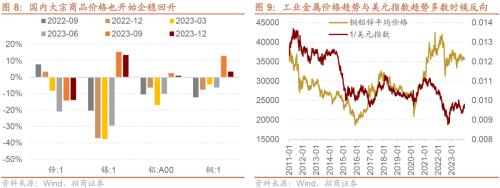

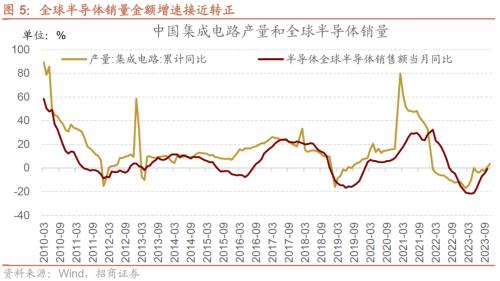

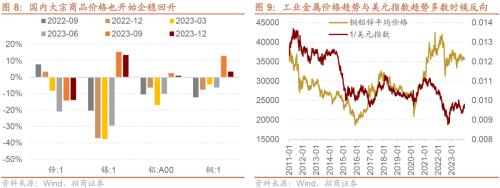

Industrial metal

Recently, with the slight improvement of global demand, the US dollar index has weakened, global commodity prices have steadily rebounded, and domestic commodity prices have also begun to stabilize and rebound. Domestic prices of copper and aluminum are positive in the fourth quarter compared with the same period of last year, and the performance is expected to continue to improve.

Due to the supply pressure, the stocks of industrial metals such as zinc and aluminum are low at present. If the global demand starts to improve marginally, the upward elasticity of prices may be greater.

?Automobile and parts

At present, the global automobile shows the general trend of electrification and intelligence. No matter whether it is electrification or intelligence, the advantages of China automobile enterprises in the world are gradually expanding. China’s share of new energy vehicles in the world continues to increase, driving China’s automobile export growth to maintain a high level.

On the domestic side, as the penetration rate of intelligent driving above L3 is promoted by Huawei cars, it is expected that next year will be the first year when the penetration rate of intelligent driving above L3 will exceed 5%. Driven by the general trend of intelligence, cars are also expected to maintain a high growth rate in domestic sales next year, and if global demand is superimposed to improve the prosperity of car sales and production next year, it is expected to remain at a high level. Judging from the spirit of the Central Economic Work Conference, the support for new energy vehicles will continue to increase next year.

home appliances

Recently, with the marginal improvement of external demand, the growth rate of export value of household appliances continues to rebound. If the world enters the interest rate cut cycle next year and the global real estate market enters the recovery stage, the export demand of household appliances is expected to remain at a high level next year. From the perspective of domestic sales. Due to the high completion rate of Baojiao Building and the obvious year-on-year increase in second-hand housing sales, the domestic sales growth rate of the overall household appliances has remained at a good level despite the decline in new housing sales.

At present, there is also a general trend of intelligence in household appliances, so household appliances also belong to the resonant choice of technological innovation plus marginal improvement of internal and external needs.

?Summary: Look at the industry layout next year from the Central Economic Work Conference and recent macro clues.

The communique of the Central Economic Work Conference has been issued, which has important guidance for the choice of industry structure next year, and scientific and technological innovation has now become the most important support direction of the policy; The opportunities brought by stronger government expenditure are also worthy of attention. Judging from the recent macro-variable changes, the Federal Reserve will become loose next year, and the marginal improvement of external demand is a high probability event; Therefore, the layout of "technological innovation+export" and "technological innovation +To G" has become an important clue to the industry layout next year.

In 2024, the fiscal expenditure is expected to increase. From the perspective of the Central Economic Work Conference, new industrialization, digital economy and artificial intelligence: among them, the policy expression of artificial intelligence has changed, from safe development to "accelerated promotion". Strategic emerging industries focus on bio-manufacturing, commercial aerospace and low-altitude economy.; Expand the scope of local government special bonds used as capital (increase support for "three major projects" and "new urbanization"); It is necessary to take the improvement of technology, energy consumption and emission standards as the traction to promote large-scale equipment renewal and trade-in of consumer goods. Stabilize and expand traditional consumption and boost large-scale consumption of new energy vehicles and electronic products. Generally speaking,TMT, durable consumer goods, machinery and equipment, and some start-up chains.It is expected to become the direction and field supported by financial expenditure next year.

Recently, a series of statements by the Federal Reserve and the fall of the global inflation center have made it possible for 2024 to become a year of loose global money and liquidity. Recently, the US dollar index has also weakened significantly, reflecting the market expectation. In the past historical samples, when the US dollar index weakened and global liquidity became loose, the import growth rate of major countries in the world often bottomed out and turned positive. Recently, China’s export growth rate has turned positive against the background that the actual base is not low, which also reflects the improvement of China’s export demand. Judging from the improvement of global demand next year,Semiconductor and consumer electronics, industrial metals, household appliances, automobiles and parts.It is an area where marginal improvement is needed at home and abroad in the near future and exports are expected to continue to improve next year.

02

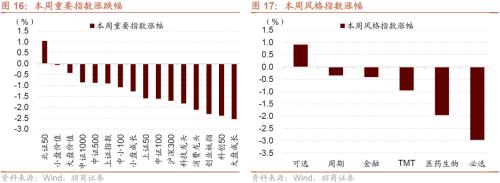

Re-examination and Vipassana-The major indexes of A-shares all fell except Beizheng 50.

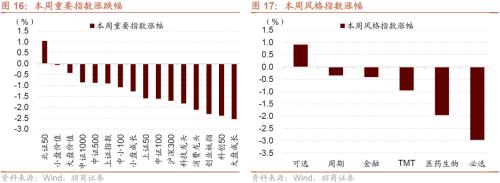

This week, all the major indexes of A shares fell except the North Securities 50.Among the main indexes, Beizheng 50 rose by 1.05%, while the small-cap value and the large-cap value declined by 0.07% and 0.43% respectively, while the leading consumer and the large-cap market did not perform well, falling by 2.12% and 2.54% respectively.

The factor affecting that global market this week are as follow:(1) The Central Economic Conference was held in Beijing; (2) The Fed has released the dove signal and is expected to cut interest rates next year; (3) US CPI in November met expectations; (4) The scale of social financing in China increased by 2.45 trillion yuan in November, 455.6 billion yuan more than the same period of last year; (5) The central bank’s net MLF investment in December reached a new high.

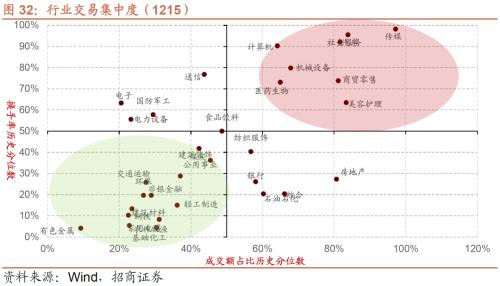

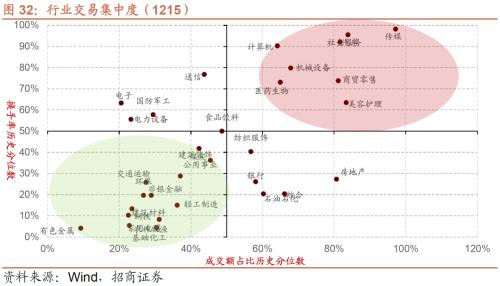

From the perspective of the industry, this week, Shenwan’s first-class industry has gone up and down. Comprehensive, media, textiles and clothing, coal, etc. were among the top gainers, while communications, power equipment, food and beverage were among the top losers.Judging from the reasons for the ups and downs, the main reasons for this week’s rising plate are comprehensive (under the reform of state-owned enterprises, the relevant constituent stocks are strong), and the media (Mango TV and Tik Tok announced the cooperation of short plays; Tencent games Yuan Meng Xing released), textiles and clothing (the influence of cold wave and flu, warm clothing and anti-drug veil caused concern); The industry reasons for the large decline are communications (adjustment of computing power plate, pressure on plate), power equipment (operating rate less than expected), food and beverage (consumption data less than expected).

03

Middle view, prosperity-In November, the automobile market continued to be hot, and the cumulative year-on-year decline in the newly started housing area from January to November narrowed.

Recently, Taiwan Stock Electronics announced its revenue in November. The revenue of most IC manufacturing, memory, silicon chips, packaging, PCB and passive components decreased year-on-year, while the revenue of IC design, lens, some panels and LED manufacturers achieved positive growth year-on-year.

IC design fieldMediaTek’s revenue in November rose by 19.23% year-on-year, and the growth rate narrowed by 9.01 percentage points. Lianyong’s revenue in November increased by 15.04% year-on-year, and the growth rate narrowed by 23.57 percentage points.IC manufacturing fieldIn November, TSMC’s revenue turned from positive to negative to-7.49% in the same month; UMC’s revenue decreased by -16.67% year-on-year, and the decline narrowed by 4.50 percentage points; World revenue decreased by 8.72% year-on-year, and the decline was narrowed by 0.07 percentage points from the previous month; Steady revenue rose by 31.12% year-on-year in the month, and the growth rate narrowed by 0.72 percentage points.Memory manufacturerNanke’s revenue turned from negative to positive to 3.71%, Winbond turned negative to -2.33%, and Wanghong’s revenue decreased by 7.34 percentage points to -34.59%.silicon chipTaishengke went down by 9.98% year-on-year, and the decline narrowed by 18.04 percentage points; The year-on-year decline of packaged solar moonlight narrowed by 3.16 percentage points to-9.31%; The year-on-year decline in revenue of PCB manufacturer Jingshuo Electronics narrowed by 14.70 percentage points to-15.71%;passive componentsmanufacturerThe year-on-year decline of Guoju’s revenue in November narrowed by 1.06 percentage points to -6.52%, the revenue of lens manufacturer Daliguang increased by 30.54%, the revenue of Yujingguang increased by 25.76%, and the revenue of Asia Optics increased by 2.95%.Panel and LED manufacturersIn China, the decline of Crystal Power expanded to -41.90%, the decline of Yiguang revenue expanded to -2.59%, and the revenue growth of Innolux and AUO narrowed to 7.81% and 15.48%.

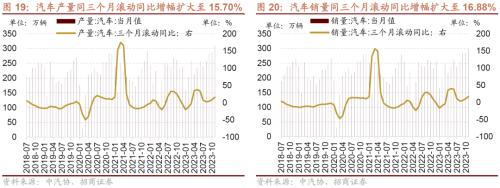

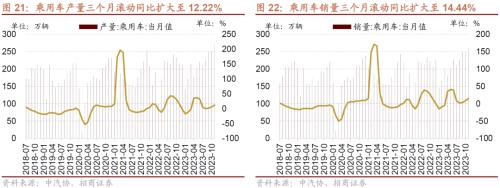

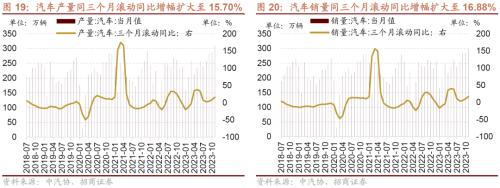

In November, the car market continued to be hot. With the help of the "double 11" promotion and other consumer waves, the demand for car purchase was further released, and the market performance continued to improve and exceeded expectations. In the same month, the production and sales of automobiles increased year-on-year, passenger cars continued their good trend, commercial vehicles maintained rapid growth, and new energy vehicles and automobile exports led the growth of the industry.In November, the production and sales of automobiles were 3.093 million and 2.97 million respectively, up 7% and 4.1% from the previous month, up 29.4% and 27.4% from the same period of last year, and the three-month rolling increased to 15.70% and 16.88% from the same period of last year. In November, the performance of the automobile market continued to improve, exceeding expectations. The automobile output reached a record high and the sales volume was close to 3 million. From January to November, the production and sales of automobiles were 27.111 million and 26.938 million, respectively, up by 10% and 10.8% year-on-year, and the growth rate was 2 and 1.7 percentage points higher than that in January-October.

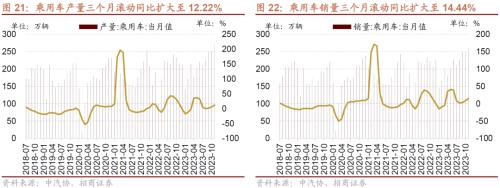

The production and sales of passenger cars increased double year-on-year.In November, the production and sales of passenger cars were 2.705 million and 2.604 million respectively, up by 7.6% and 4.7% from the previous month, up by 25.6% and 25.3% from the same period last year, and expanded to 12.22% and 14.44% from the same period last year. The reason for this month’s rapid growth is on the one hand affected by the hikes at the end of the year, and on the other hand related to the low base in the same period last year. From January to November, the production and sales of passenger cars were 23.441 million and 23.272 million respectively, up by 8% and 9.3% respectively.

The market share of China brand passenger cars has risen rapidly.China brand passenger cars sold 1.556 million vehicles in November, a year-on-year increase of 37.9%; The market share was 59.7%, up by 5.4 percentage points. China brand passenger cars sold 12.978 million vehicles from January to November, up 23.8% year-on-year, with a market share of 55.8%, up 6.6 percentage points.

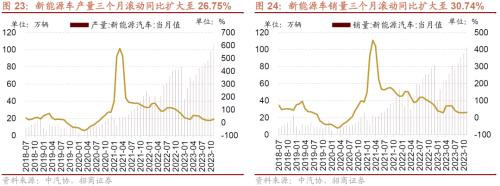

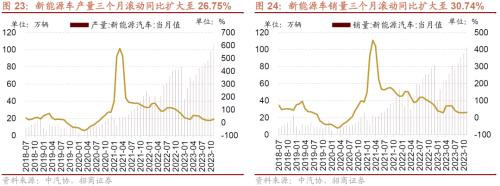

The production and sales of new energy increased rapidly year-on-year, and the market share remained high.In November, the production and sales of new energy vehicles were 1.074 million and 1.026 million respectively, up by 39.2% and 30% year-on-year, respectively. The three-month rolling year-on-year growth rate expanded to 26.75% and 30.74% respectively, and the market share reached 34.5%. From January to November, the production and sales of new energy vehicles were 8.426 million and 8.304 million respectively, up by 34.5% and 36.7% respectively, and the market share reached 30.8%.

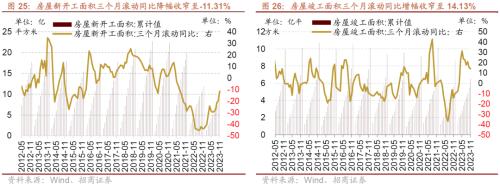

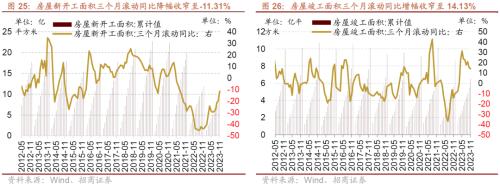

one-In November, the cumulative year-on-year decline in newly started housing area narrowed, and the cumulative year-on-year increase in completed housing area narrowed; The cumulative year-on-year decline in commercial housing sales and commercial housing sales area has expanded; The year-on-year decline of investment in real estate development has expanded, and the cumulative decline of real estate development funds has narrowed.From January to November, the cumulative value of newly started housing area was 875 million square meters, down 21.20% year-on-year, which was 2 percentage points lower than that in January-October, and the three-month rolling year-on-year decline narrowed to -11.31% (the previous value was -19.70%). From January to November, the cumulative value of completed housing area was 652 million square meters, up 17.90% year-on-year, which was 1.1 percentage points lower than the previous value, and the three-month rolling year-on-year increase was narrowed to 14.13% (the previous value was 15.19%).

From January to November, the cumulative value of commercial housing sales was 10.53 trillion yuan, down 5.20% year-on-year, with a decrease of 0.3 percentage points, and the three-month rolling year-on-year decrease narrowed to -17.14% (the previous value was-19.23%); From January to November, the cumulative sales area of commercial housing was 1.005 billion square meters, down 8.00% year-on-year, with a decrease of 0.2 percentage points, and the three-month rolling year-on-year decrease narrowed to -20.38% (previous value-21.17%); From January to November, the cumulative value of investment in real estate development was 10.40 trillion yuan, down 9.40% year-on-year, and the decline was 0.10 percentage points higher than the previous value. The three-month rolling year-on-year decline narrowed to -17.88% (the previous value was -18.21%).

From January to November, real estate development accounted for 22.58% of the total investment in fixed assets. From January to November, the total accumulated value of real estate development funds was 11.70 trillion yuan, down 13.40% year-on-year, and the decline was narrowed by 0.4 percentage points compared with the previous value. The three-month rolling year-on-year decline was narrowed to -15.68% (the previous value was -20.65%).

04

Funds and numbers-Net inflow of financing funds, net subscription of ETF

Judging from the capital flow in the whole week, this week, there was a net outflow of funds from the north, a net inflow of financing funds, a decline in Public Offering of Fund, a newly established partial stock class, and a net subscription of ETFs. Specifically, the net outflow of northbound funds this week was 18.58 billion yuan; The total net inflow of financing funds in the first four trading days was 5.71 billion yuan; 2.21 billion shares of Public Offering of Fund were newly established, down 4.04 billion shares from the previous period; ETF net subscription, corresponding to a net inflow of 18.39 billion yuan.

From the perspective of ETF net subscription, ETF net subscription and broad index ETF are all net subscriptions, of which Kechuang 50ETF has the most subscriptions; Industry ETFs are mainly net purchases, among which medical ETFs are more purchased and financial real estate ETFs (excluding brokers) are more redeemed.Specifically, the total net subscription of equity ETFs was 18.56 billion. Among them, Shanghai and Shenzhen 300, Growth Enterprise Market ETF, CSI 500ETF, SSE 50ETF, Shuangchuang 50ETF and Kechuang 50ETF respectively purchased 170 million shares, 1.58 billion shares, 140 million shares, 1.60 billion shares, 100 million shares and 3.69 billion shares. In terms of industry, the net subscription of information technology ETFs was 1.42 billion; 300 million net purchases of consumer ETFs; The net subscription of pharmaceutical ETFs was 3.31 billion; Securities ETF net subscription of 260 million; Net redemption of 510 million financial real estate ETFs; The net redemption of military ETF was 320 million; The net purchase of raw material ETF is 0.3 billion copies; The new energy & smart car ETF net subscription was 360 million.

This week, the scale of newly established partial stock funds in Public Offering of Fund dropped from the previous period, with 2.21 billion newly established partial stock funds.

This week (December 11-December 15), the net outflow of northbound funds was 18.58 billion yuan, and the net outflow expanded by 12.79 billion yuan.In terms of industry preference, public utilities, real estate, automobiles, etc. have a higher net purchase scale, with net purchases of 760 million yuan, 420 million yuan and 410 million yuan respectively; Centralized sales of food and beverages, electronics, medicine and biology, etc., the net sales scale reached-3.29 billion yuan,-2.30 billion yuan and-2.17 billion yuan.

In terms of individual stocks, Changjiang Electric Power, Mindray Medical, BYD, etc. have higher net purchases of funds in the north; The net selling scale is higher, including Wuliangye, Yili, Sailisi, etc.

In terms of financial integration, the net inflow of financing funds in the first four trading days was 5.71 billion yuan.From the perspective of industry preferences, this week’s financing funds concentrated on buying computers, with a net purchase of 1.38 billion yuan. Other industries with the highest net purchase mainly include food and beverage, non-bank finance, and automobiles. The net sales are mainly power equipment, national defense and military industry, agriculture, forestry, animal husbandry and fishery. From the perspective of individual stocks, the stocks with higher net financing purchases include Kweichow Moutai, Changan Automobile, Celes, etc., and the stocks with higher net sales mainly include century huatong, Jianghuai Automobile and Contemporary Amperex Technology Co., Limited.

From the perspective of capital demand, the scale of major shareholders’ net reduction is reduced, and the scale of planned reduction is increased.This week, the secondary market of important shareholders increased their holdings by 490 million yuan, reduced their holdings by 2.43 billion yuan, and reduced their net holdings by 1.94 billion yuan. Among them, industries with higher net holdings include national defense, automobile, transportation, etc. Industries with higher net reduction include electronics, basic chemical industry, pharmaceutical biology and so on. The planned reduction announced this week is 2.11 billion yuan. Compared with the previous period.

05

Theme, wind direction-The White Paper on AI PC Industry (China) was released, and Intel launched the first AI PC chip.

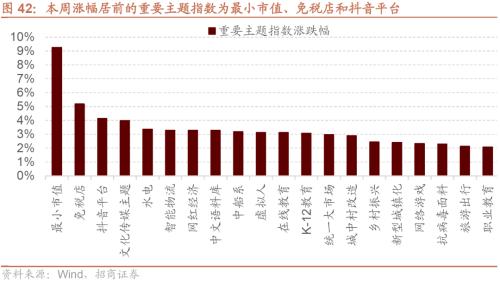

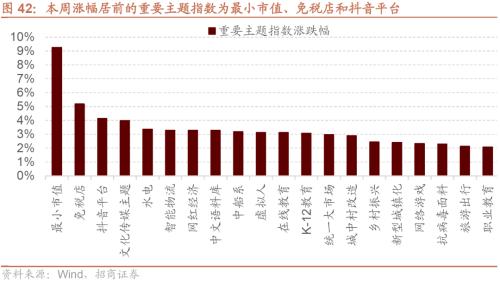

This week, the main indexes of A-shares rose less and fell more. Zhou Du, the Shanghai and Shenzhen 300 Index fell by 0.96%, and the Growth Enterprise Market Index fell by 2.31%. The major theme indexes of A-shares with the highest gains are minimum market value, duty-free shops and Tik Tok platform.

The theme events worthy of attention this week and next week are:

(1) Important Meeting-The Central Economic Work Conference was held in Beijing, and the Supreme Leader delivered an important speech (☆☆☆).

The Central Economic Work Conference was held in Beijing from December 11th to 12th. The meeting pointed out that it is necessary to overcome some difficulties and challenges to further promote the economic recovery, mainly due to insufficient effective demand, overcapacity in some industries, weak social expectations, still many hidden risks, blockage in the domestic macro-cycle, and the complexity, severity and uncertainty of the external environment. It is necessary to enhance the sense of hardship and effectively deal with and solve these problems. On the whole, the favorable conditions for China’s development are stronger than the unfavorable factors, and the basic trend of economic recovery to be good and long-term to be good has not changed. It is necessary to enhance confidence and confidence. The meeting stressed that to do a good job in economic work next year, we should fully implement the spirit of the 20th National Congress of the Communist Party of China and the Second Plenary Session of the 20th Central Committee under the guidance of Socialism with Chinese characteristics Thought, adhere to the general tone of striving for progress while maintaining stability, implement the new development concept completely, accurately and comprehensively, accelerate the construction of a new development pattern, focus on promoting high-quality development, comprehensively deepen reform and opening up, promote high-level science and technology to stand on its own feet and strengthen macro-control. We will make overall plans to expand domestic demand and deepen structural reform on the supply side, make overall plans for new urbanization and overall rural revitalization, make overall plans for high-quality development and high-level security, effectively enhance economic vitality, prevent and defuse risks, improve social expectations, consolidate and enhance the positive trend of economic recovery, continue to promote effective improvement in quality and reasonable growth in quantity of the economy, enhance people’s livelihood and well-being, maintain social stability, and comprehensively promote the building of a strong country and the great cause of national rejuvenation with Chinese modernization.

News source: http://www.news.cn/2023-12/12/c_1130022917.htm.

(2) Capital market policy-Beijing and Shanghai adjust and optimize the policies related to house purchase (☆☆☆).

According to a report by Cailian on December 14th, two first-tier cities, Beijing and Shanghai, adjusted and optimized the policies related to house purchase on the same day. The minimum down payment ratio of Beijing’s first housing personal housing loan is uniformly lowered to 30%; The minimum down payment ratio of individual housing loans for two sets of housing will be reduced to 50% in six urban districts and 40% in six non-urban districts. The lower limit of the interest rate of the first commercial individual housing loan in Shanghai is adjusted to be no less than the loan market quotation rate (LPR) of the corresponding term minus 10 basis points, and the minimum down payment ratio is adjusted to be no less than 30%.

News source: https://www.cls.cn/detail/1544250.

(3) New energy vehicles-The Ministry of Industry and Information Technology and other three departments adjust the technical requirements of new energy vehicles for vehicle purchase tax exemption (☆☆☆)

The Ministry of Industry and Information Technology and other three departments issued the "Announcement on Adjusting the Technical Requirements of New Energy Vehicle Products for Reducing Vehicle Purchase Tax". Among them, it is proposed that from January 1, 2024, the models applying to enter the Catalogue of New Energy Vehicles with Vehicle Purchase Tax Exemption shall meet the technical requirements of new energy vehicles. Among them, the battery-changing model vehicles also need to provide third-party test reports that meet the requirements of GB/T 40032 "Safety Requirements for Battery-changing of Electric Vehicles" and other standards, as well as certification materials that the production enterprises guarantee the battery-changing service. If the enterprise builds its own power station, it shall provide the design drawings and ownership certificate of the power station; Commissioned by the power exchange service, it is necessary to provide materials such as vehicle type, matching certificate of power exchange station and cooperation agreement between the two parties. January 1, 2024 to May 31, 2024 is the transition period. From January 1, 2024, the models that have entered the Catalogue of New Energy Vehicles Exempted from Vehicle Purchase Tax before December 31, 2023 (hereinafter referred to as the Duty Free Catalogue) and are still valid will be automatically transferred to the Catalogue of Tax Reduction and Exemption. Relevant models should upload the tax reduction and exemption logo and the power exchange mode logo in time, and the corresponding supporting materials should be supplemented according to the requirements of this announcement for the power exchange mode models and fuel cell models. From June 1, 2024, vehicles that do not meet the technical requirements of this announcement will be revoked from the Catalogue of Tax Reduction and Exemption. From June 1st, 2024, Announcement on Exemption of Vehicle Purchase Tax for New Energy Vehicles (Announcement No.172, 2017, Ministry of Science and Technology, Ministry of Finance, State Administration of Taxation)The technical requirements in Announcement on Adjusting the Technical Requirements of New Energy Automobile Products Exempted from Vehicle Purchase Tax (Announcement No.13 of the Ministry of Industry and Information Technology, Ministry of Finance and State Administration of Taxation in 2021) are abolished.

News source: https://wap.miit.gov.cn/zwwk/zcwj/wjfb/gg/art/2023/art _ 62216a 180da4437 cad5c2710e4b6924e.html.

(4) artificial intelligence-seven departments: support artificial intelligence enterprises to develop large-scale audio-visual application models (☆☆ ☆)

Seven departments, including the Ministry of Industry and Information Technology, issued the Guiding Opinions on Accelerating the High-quality Development of Audio-visual Electronics Industry. Among them, it is proposed to support leading color TV enterprises to enrich the product matrix, improve the industrial chain, explore overseas markets, continuously enhance ecological dominance and lead the development of the industry. Encourage OEM speakers, headphones and microphones to develop their own brands, and enhance the added value of products and industry influence. Accelerate the cultivation of "little giants" specializing in commercial display, car audio-visual and audio-visual fields and individual champions in manufacturing. Support backbone enterprises to become bigger and stronger, and support artificial intelligence enterprises to develop large models of audio-visual applications. Promote enterprises to establish advanced quality management system, carry out quality management ability evaluation, and encourage enterprises to climb to excellent quality.

News source: https://wap.miit.gov.cn/zwwk/zcwj/wjfb/tz/art/2023/art _ 01d14530905f49ca812d 230db064a502.html.

(5) Economic data-The central bank invested 800 billion yuan through MLF today, the largest in a single month since records began (☆☆☆).

According to a report by Cailian on December 15th, the central bank launched a 7-day reverse repurchase of 50 billion yuan and a one-year MLF operation of 1,450 billion yuan in the open market today, and the winning bid rates remained unchanged, at 1.80% and 2.50% respectively. Today, there are 197 billion yuan reverse repurchase and 650 billion yuan MLF due. The central bank made a net investment of 800 billion yuan through MLF, the largest in a single month on record.

News source: https://www.cls.cn/detail/1544762.

(6) Smart cars-Huawei will release the M9(☆☆☆) on December 26th.

According to the news of Cailian on December 14, Huawei officially announced that it will hold a press conference on M9 and Huawei in winter on December 26. As the flagship SUV of HarmonyOS Zhixing, the current pre-sale price of the M9 is 500,000 ~ 600,000 yuan.

News source: https://www.cls.cn/detail/1543731.

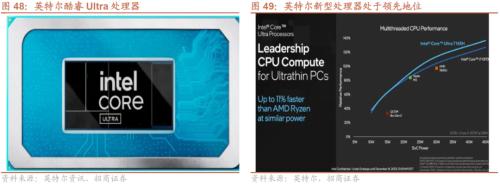

(7) Semiconductor chip-Intel released the first AI PC processor (☆☆☆).

On December 14th, Intel Corporation released the first 14th generation Core Ultra mobile processor with built-in AI acceleration engine NPU, which is the first product based on Intel 4 process technology. CEO Pat Gelsinger also demonstrated the Intel Gaudi 3 series AI accelerator for deep learning and large-scale generation of artificial intelligence models for the first time, which is expected to be listed as scheduled next year. On the same day, Intel also released the fifth generation Xeon processor. Intel said that servers based on the new Xeon processor will be widely launched in the first quarter of next year; The performance of Gaudi accelerator exceeds that of NVIDIA H100 accelerator.

News source: https://www.chinastarmarket.cn/detail/1544696.

(8) Robots-Tesla shows the second generation humanoid robot of Optimus (☆☆☆).

On December 13th, Tesla released the video of Optimus-Gen 2 (the second generation of Optimus Prime)-and it’s only less than three months since the first generation of Optimus released the video of "the first show of intelligent end-to-end solution"; It’s only been nine months since the first generation of Optimus came out. According to the video, the second-generation Optimus is equipped with actuators and sensors designed by Tesla, 2-DOF driving neck, 11-DOF dexterous hand with faster response, tactile sensor (ten fingers), actuator integrated electronics and wiring harness, foot force/torque sensor, articulated toes, etc. Moreover, many performances of the second generation Optimus have been significantly improved: the walking speed has been increased by 30%, the weight has been reduced by 10kg, and the balance and whole body control have been improved.

News source: https://www.chinastarmarket.cn/detail/1542644.

(9) Economic data-the CPI of the United States increased by 3.1% in November, which was in line with market expectations (☆☆☆).

According to a report by Cailian on December 12th, the CPI of the United States in November increased by 3.1% year-on-year, estimated at 3.1%, and the previous value was 3.2%. In November, the CPI increased by 0.1% month-on-month, with the forecast of 0.0% and the previous value of 0.0%. In November, the seasonally adjusted core CPI rose by 4% year-on-year, with an expected 4.00% and a previous value of 4.00%. In November, the core CPI rose by 0.3% month-on-month, with an expected 0.30% and a previous value of 0.20%.

News source: https://www.cls.cn/detail/1542152.

https://www.cls.cn/detail/1542154

(10) Capital market policy-The Federal Reserve will keep the benchmark interest rate unchanged in the range of 5.25-5.5% (☆☆☆).

According to a report by Cailian on December 14th, the Federal Reserve announced that it would keep the target range of the federal funds interest rate unchanged at 5.25% to 5.5%, which was in line with the general market expectation. This is the third consecutive time that the Fed has suspended interest rate hikes since the meeting on interest rates in September this year. It is widely believed that the Fed’s interest rate hike cycle is over. The Federal Reserve started this interest rate hike cycle in March 2022. As of July this year, it raised interest rates 11 times, with a cumulative rate hike of 525 basis points.

News source: https://www.cls.cn/detail/1543417.

This week’s industry watch-The "White Paper on AI PC Industry (China)" was released, Intel launched a new processor, and the AI PC industry accelerated its landing.

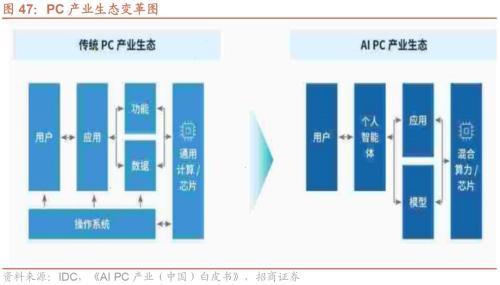

On December 7th, at the first AI PC Industry Innovation Forum, Lenovo and IDC released the industry’s first White Paper on AI PC Industry (China).The White Paper discusses the inevitability of the combination of AI and PC, focusing on the definition, value and product characteristics of AI PC, as well as the changes that AI has brought to PC industry ecology, and analyzes and predicts the future market development, providing a framework guidance for the accelerated development of AI PC and the co-creation and upgrading of industrial ecology.

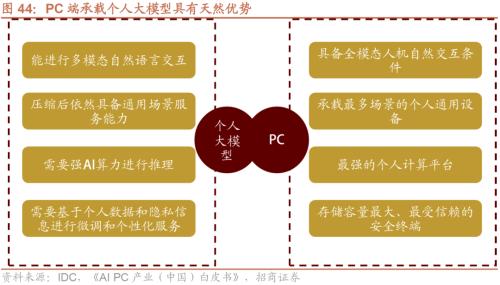

With the rapid development of large-scale models, it is an inevitable trend to integrate personal large-scale models with terminals.Since 2022, the generative AI technology based on large models has made a major breakthrough and developed rapidly, the performance of large models has been continuously improved, and multi-modal evolution has been continuously promoted. GPT-4 and Gemini have been formed abroad, and major domestic technology companies have also released their own large model products, with a significant trend of self-control. On the application side, it is difficult for the public big model to meet the personalized needs of thousands of people, and the computing load of the big model will inevitably sink from the cloud to the terminal, forming a personal big model that can better meet the personalized needs and deeply integrate with the mobile terminal, which is the inevitable trend of the development of the big model.

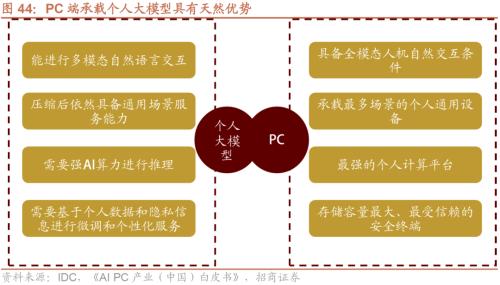

Compared with other devices, PC-side carrying personal big model has unique advantages.First of all, PC has full-mode human-computer interaction conditions. In addition to direct touch, voice and gesture interaction, traditional keyboard-mouse interaction and digital pen interaction provide users with more accurate and professional operation means, which enables large models to handle highly complex user tasks better and more accurately. Secondly, PC is a personal general-purpose device that carries the most scenes. Compared with other terminals such as mobile phones, PC has the most extensive application scenarios, and can undertake many tasks such as teleconferencing, graphic design, programming and multimedia production. It also has more functions and advanced options in professional tools, which can provide a richer working environment for large models. Thirdly, PC is by far the strongest personal computing platform, which has a balance between strong computing power and portability, and can realize the collaborative operation of heterogeneous computing power of CPU+NPU+GPU, and can deploy more complex and powerful AI models. Finally, PC is the most trusted and secure terminal with the largest storage capacity. In the process of interacting with AI, a large amount of personal data will be generated, which requires higher capacity and security. The PC has a large-capacity local secure storage, which puts forward a solution to this problem.

As a personal AI assistant, AI PC has broad application prospects.After deep integration with the personal model, each AI PC is a tailor-made personal AI assistant with broad application prospects. AI PC can provide personalized creative services, private secretarial services and equipment housekeeping services for work, study and life, and improve work and study efficiency and quality of life. At the same time, due to the large model ability of AI PC application localization, it has the advantages of more timely response, lower cost, safer and more reliable, and can better play the role of personal AI assistant. In terms of product form, desktop computers, notebook computers and tablet computers can all be realized and can be flexibly combined to meet the different needs of users.

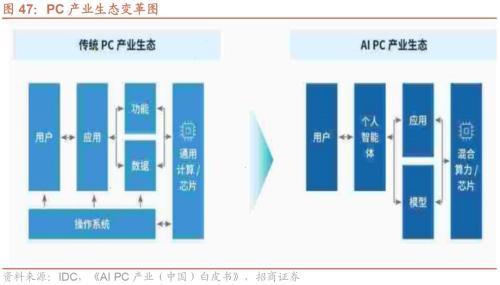

AI PC has changed from application-oriented to people-oriented, from application-driven to intention-driven, and promoted the change of PC industry ecology. On the user side, through personalized AI big model service, users have become the drivers and creators of industry ecological innovation, and AI PC is no longer just a cold tool, but a "class partner" relationship, and the awareness of data sovereignty and privacy protection has also been greatly improved. In terms of manufacturers, terminal manufacturers will be advanced from simple producers to ecological organizers, AI technology manufacturers will be committed to developing hybrid artificial intelligence technologies and services, and the application side will form a brand-new pattern of "creative applications & professional applications" for common development, and computing power manufacturers will pay more attention to the development of inclusive hybrid computing power in the end, edge and cloud collaboration.

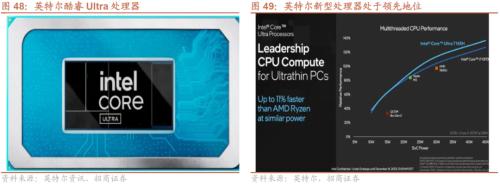

Intel launched a new AI PC processor to accelerate the upgrade of AI PC.In October this year, Intel introduced the AI PC acceleration plan, proposing to realize AI features for 100 million PCs by 2025. On December 14th, local time, Intel presented new AI hardware at the "AI Everywhere" event held in new york, and officially launched the AI PC processor, namely the new Core Ultra processor code-named Meteor Lake. Core Ultra processors will have three different configurations, namely Core Ultra 5, Core Ultra 7 and Core Ultra 9. According to Intel, compared with notebook processors such as AMD Ryzen 7 7840U, Qualcomm Snapdragon 8cx Gen 3 and Apple’s self-developed M3 chip, the multithreading performance of Core Ultra 7 165H chip has improved by 11%. Compared with the previous Intel Core i7-1370P, its power consumption is reduced by 25% and 79% compared with AMD’s Ryzen 7 7840U. The flagship product Intel Core Ultra 9 185H will be the leader in this field, with 16 cores and 22 threads. All Intel’s new CPUs will also be equipped with NPU, which can perform tasks driven by artificial intelligence, making it truly a processor adapted to AI PC, and can also achieve better video calls, better graphics and longer battery life of notebook computers.

The product will accelerate its landing, and it will become the first year of AI PC in 2024.Intel’s Core Ultra 9 185H processor will be launched in 2024, and most other Meteor Lake chips will be released today. A large number of new notebook computers have adopted new Intel Core Ultra chips, including MSI, Asus, Lenovo, Acer and other well-known manufacturers. Intel itself plans to launch a new personal computer driven by artificial intelligence semiconductor chips, and these products are expected to be launched next year. In addition to Intel, AMD recently launched a new Ruilong 8040 series processor, and it is expected that a number of manufacturers cooperating with AMD will launch a new AI PC; next year; Microsoft will also launch Windows 12 system in 2024, and AI will be deeply involved in many tasks such as performance deployment and operation assistance. Driven by major manufacturers, AI PC products have been accelerated, and the "first year of AI PC" is coming soon. At the same time, AI PC also has a lot of room for development in China. According to the White Paper, the total sales of AI laptops and AI desktops will rapidly climb from 14.1 billion in 2023 to 131.2 billion in 2027, an increase of 8.3 times. Double catalysis at home and abroad, it is suggested to pay attention to investment opportunities in related industrial chains.

06

Data and valuation-The overall A-share valuation is lower than last week.

The valuation of all A shares this week is lower than last week.As of the close of December 15th, the PE(TTM) of all A shares was 13.2, which was 22.4% of the historical valuation level. Growth enterprise market PE(TTM) went down 0.5 to 31.4, which was at the 3.9% quantile of historical valuation level. The PE(TTM) of the Shanghai-Shenzhen 300 Index, which represents large-cap stocks, went down by 0.1 to 10.2, which was 15.8% of the historical valuation level. The PE(TTM) of the CSI 500 Index, which represents small and medium-sized stocks, went down 0.2 to 17.8, which was 10.8% of the historical valuation level.

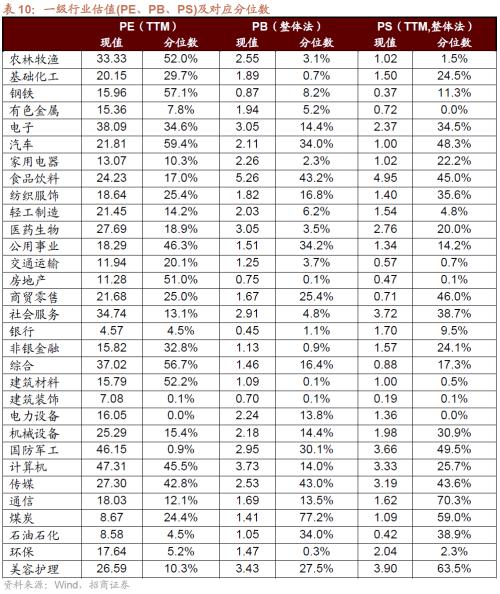

In terms of industry valuation, this week’s sector valuation was mixed. Among them, comprehensive, media and social services were among the top gainers, while food and beverage, medicine, biology and computers were among the top losers.The valuation of the comprehensive sector rose by 1.58 to 37.0, which was in the historical position of 56.7%; The valuation of the media sector rose by 0.75 to 27.3, which was in the historical position of 42.8%; The valuation of the social service sector rose by 0.45 to 34.7, which was in the historical position of 13.1%; The valuation of the food and beverage sector fell by 1.10 to 24.2, which was in the historical position of 17.0%; The valuation of the pharmaceutical biological sector fell by 0.55 to 27.7, which was at the historical level of 18.9%; The valuation of the computer sector fell by 0.45 to 47.3, which was in the historical score of 45.5%. As of the close of December 15th, the top five industries in the first-level industry valuation were computer, national defense, electronics, integration and social services.