On the evening of November 9, LI announced its financial report for the third quarter of 2023. The company’s quarterly delivery volume and financial data both hit record highs, with operating profit and net profit of 2.34 billion yuan and 2.81 billion yuan respectively in the same period, achieving four consecutive quarters of profit. As of September 30th, the accumulated revenue of LI in 2023 was 82.12 billion yuan. According to the current development trend, it is within sight to achieve the goal of 100 billion revenue by the end of the year.

For the next development, Li Xiang, Chairman and CEO of LI, said at the performance exchange meeting in the third quarter of 2023 that night that in October, Changzhou manufacturing base in LI completed the capacity upgrade, preparing for the fourth quarter production climbing. In the aspect of supply chain management, the bottleneck of spare parts supply is constantly broken by optimizing management strategy, upgrading management process and strengthening efficient cooperation with suppliers. It is estimated that the total delivery volume of the company will reach 125,000 to 128,000 units in the fourth quarter.

The performance is the best in history

According to the financial report, in the third quarter of 2023, LI delivered 105,108 vehicles, up by 296.3% year-on-year. In this quarter, it won the first place in SUV models and new energy vehicles with a price of over 300,000 yuan.

Image source: LI Financial Report

With the intensification of competition in the domestic new energy vehicle market, the market share of head enterprises has been increasing. In the third quarter of this year, the penetration rate of LI in the new energy vehicle market of over 200,000 yuan reached 15.4%, an increase of 4.5 percentage points over the first quarter.

"I believe that the continued strong sales performance of the ideal L series and the delivery of new pure electric vehicles next year will support LI to further replace traditional fuel vehicles on a large scale in 2024." Li wants to say.

Image source: LI Financial Report

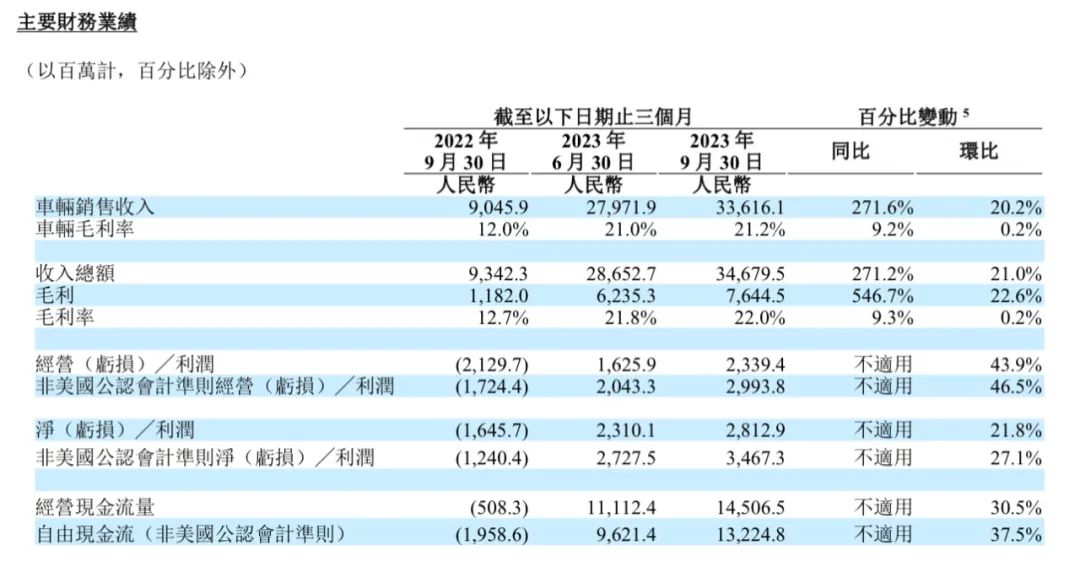

Strong market demand boosted LI’s revenue growth. In the third quarter of this year, the company achieved revenue of 34.68 billion yuan, a year-on-year increase of 271.2%. In the same period, the company’s operating profit and net profit were 2.34 billion yuan and 2.81 billion yuan respectively. The above quarterly delivery volume and financial data are all the best in history.

It is worth noting that LI’s cost has been continuously reduced, with a gross profit margin of 22.0% in the third quarter. In addition, the free cash flow is 13.22 billion yuan. At the end of the third quarter, the company’s cash reserve reached 88.52 billion yuan, which also effectively guaranteed LI’s long-term investment in R&D and new product layout.

In terms of R&D, LI’s R&D expenditure in the third quarter was 2.82 billion yuan, a year-on-year increase of 56.1%. LI said that the increase in R&D expenses will further expand the scale of R&D talents, expand the product matrix and enhance the R&D innovation capability. Based on the "dual-energy strategy", the company promotes the technical layout of extended-range electric, high-voltage pure electric, intelligent driving, intelligent space, system research and development and forward-looking research and development.

It is expected to maintain a high growth rate.

LI also looked forward to the fourth quarter of 2023 in the financial report. The company’s delivery volume in the fourth quarter is expected to reach 125,000 to 128,000, an increase of 169.9% to 176.3% year-on-year; Revenue in the fourth quarter is expected to reach 38.46 billion yuan to 39.38 billion yuan, up 117.9% year-on-year to 123.1%. On this basis, it is a high probability that LI’s revenue will exceed 100 billion yuan this year.

A few days ago, LI disclosed the delivery data in October this year, showing that the company delivered 40,422 new cars that month, up 302.1% year-on-year, and the monthly delivery exceeded 40,000 vehicles for the first time.

"LI ushered in the moment of delivering more than 40,000 vehicles per month, marking the further improvement of the company’s organizational capabilities such as manufacturing, sales and service." Li Xiang said, "This is also the first time that China’s new car companies have reached this scale, and LI has entered a new cycle of accelerating large-scale development."

Li Xiang introduced that in the fourth quarter, LI will continue to accelerate the expansion of stores, aiming to have more than 400 stores covering 140 cities nationwide by the end of this year, so as to increase its market share in the new energy vehicle market in China.

Regarding the progress of the ideal MEGA concerned by the market, Li Xiang said at the performance exchange meeting that the ideal MEGA will be officially released in December this year, and the car will be exhibited in the store in January 2024 and delivered by users in February. "All our pure electric products must have" three important breakthroughs ",namely, the breakthrough in charging, the breakthrough in space and the breakthrough in modeling. All pure electric products in LI will adhere to these three important principles." Li wants to say.

Based on this, the ideal MEGA integrates the latest technological achievements of LI in the field of pure electricity, and carries out research and development and manufacturing according to the above-mentioned "three important breakthroughs".

Li Xiang also said that the company will continue to expand the construction of 5C high-voltage super charging network. Up to now, LI has built and operated 130 ideal super charging stations along the national expressway. By the end of this year, LI will have completed the construction of 300 high-speed super charging stations, covering the four economic belts of Beijing-Tianjin-Hebei, Yangtze River Delta, Greater Bay Area and Sichuan-Chongqing.

"In the future, we will speed up the laying of the ideal overcharge network, encrypt and cover the national high-speed network while promoting the layout of urban overcharge stations, and enhance the user’s full-scene recharge experience." Li wants to say.