[Autohome Industry] Autohome E Week, learn about the major events in the field of smart electric vehicles in the week. This week, the most concerned thing in the industry is the "third chapter of the grand plan" released by Tesla. Previously, Musk himself had warmed up to related events on Twitter, which caused Tesla’s share price to soar continuously. However, after the plan was officially released, Tesla’s share price actually ushered in a low ebb; after the release of Geely Galaxy, Changan Automobile issued a lawyer’s letter accusing the former of plagiarism in design; in early March, various companies rushed to release the sales report card in February, and BYD once again led by an absolute advantage… What other major events are there this week? Let’s take a look.

■ Falling below 390,000 yuan/ton, will the price of lithium carbonate continue to fall?

Audi announces latest plan for electrification transition

The third chapter of the ambitious plan: Musk wants to use 10 trillion to transform the earth

Sales of new energy vehicle companies in February: BYD wins the championship

■ Changan accuses Geely of plagiarizing the appearance of Galaxy, Geely refutes

■ Annual revenue 45.29 billion ideal release of 2022 financial results

■ Annual revenue 49.27 billion yuan NIO released 2022 annual financial report

■BYD will launch a new brand

Falling below 390,000 yuan/ton, the price of lithium carbonate will continue to fall?

According to data released by Shanghai Steel Union, on March 2, the price of battery-grade lithium carbonate continued to fall by 5,000 yuan/ton, and the average price has reached 382,500 yuan/ton. Compared with the high price of 600,000 yuan/ton in November last year, the decline has exceeded 30%.

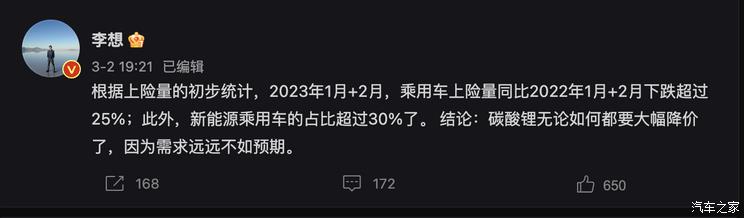

Li Xiang, chief executive of Li Auto, attributed the continued fall in the price of lithium carbonate to falling demand. On Weibo, he cited insurance data showing that in the first two months of 2023, passenger car insurance fell by more than 25% compared with the same period last year. "Lithium carbonate prices are going to drop significantly anyway because demand is far less than expected."

Some time ago, power battery giant Ningde Times launched a lithium mine rebate plan to ensure power battery market share at the expense of part of the price. From the details, the company targets several strategic customers such as Ideal, NIO, Huawei, and JK to settle part of the power battery at a price of 200,000 yuan/ton of lithium carbonate in the next three years, but the companies that signed the cooperation agreement need to entrust 80% of the battery purchase share to Ningde Times.

According to Reuters, CATL recently sold its 5% stake in Australian lithium producer Pilbara Mining at a price of 601 million Australian dollars. Perhaps this transaction can also objectively reflect the giant’s expectations for the price trend of lithium carbonate.

Audi Announces Latest Plan for Electrification Transformation

Last month, the European Union Parliament formally approved the Zero Emission Agreement for New Fuel Cars and Small Vans in Europe for 2035, agreed by the European Commission and the European Council. The goal of the agreement is to stop the sale of new fuel cars and small vans in the 27 countries of the European Union in 2035. The ban will ensure that the European Union will achieve zero greenhouse gas emissions by 2050, based on the 15-year lifespan of ordinary household light vehicles.

Although the German transport minister has said that he will not support the above-mentioned agreement, the German car company Audi has made more radical adjustments to its electrification transformation strategy. According to the company, starting from 2026, Audi’s new models launched for the global market will be fully switched to pure electric vehicles, and by 2033, the production of internal combustion locomotives will be gradually stopped. Under the guidance of the global strategy, Audi is steadily advancing the preparation of pure electric vehicle production at its own production base.

Data show that in 2022, although Audi’s sales declined by nearly 4% compared with 2021, reaching 1.61 million vehicles, it can achieve outstanding results in the field of electrification. The cumulative sales of electric vehicles reached 118,000 vehicles during the year, an increase of 44.3% year-on-year.

In China, Audi FAW’s new PPE plant started in June last year and is expected to start production in 2024. The first mass-produced model is the Audi A6e-tron. According to the previously announced plan, the company will provide 5 locally produced pure electric vehicles in the domestic market by 2025, and about 30 new energy vehicles globally.

The third chapter of the ambitious plan: Musk wants to use 10 trillion to transform the earth

On March 1, local time, Tesla held an investor conference and officially released the third chapter of the grand plan. But after the conference, the feedback from capital markets was relatively dismal. On the day after the release, the company’s stock price fell by more than 5% after hours. The next day, the company’s stock price closed down 5.85%, wiping $27.557 billion off its market value. On the third day, although the stock price rebounded, it still did not reach the level before the conference.

The reason for the sluggish stock price trend can be attributed to the content of the third chapter of the grand plan. Musk spent a lot of time to introduce his grand ideals, including the complete transformation of electrification, not only in the field of transportation, but also in industry, family life, shipping and shipping; to build a 240 TWh energy storage system, so that the grid can bear the pressure of full electrification; to achieve energy sustainability, to build 30 TW of renewable power generation. To achieve this goal, Musk believes that it will cost $10 trillion, equivalent to 10% of global GDP in 2022.

The above plan is so ambitious that some investors are worried about whether it can come true. Outside the grand framework, Tesla has not released the "details" that the outside world is concerned about, such as the legendary Model Q, 4680 battery, self-driving hardware HW4.0, etc.

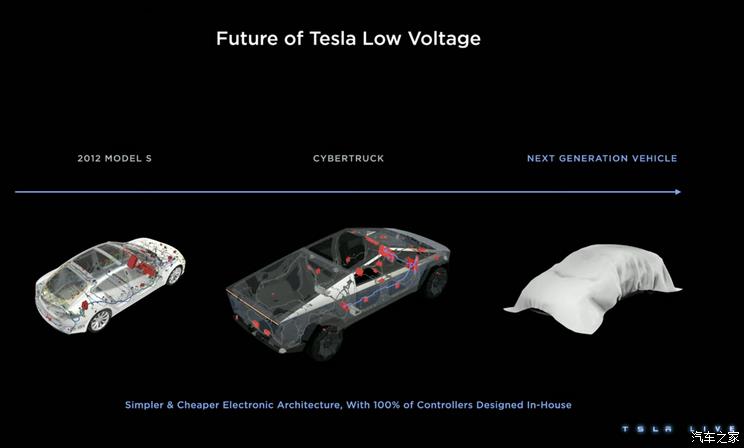

However, in terms of manufacturing, Tesla has released a lot of strong news. The company said it will change the car production model, carry out more in-depth automated production, assemble all parts of the vehicle at the same time, and then assemble the whole vehicle according to demand, which will reduce the production cost of next-generation cars by 50%; the next-generation power platform will no longer use rare earth materials, and reduce the use of silicon carbide by 75% to save $1,000 in costs.

February new energy vehicle sales rankings: BYD wins the championship

According to the information released by the Federation of Passengers, the national new energy passenger vehicle market picked up smoothly in February. The market trend is expected to increase by 30% compared with January and 60% compared with February last year, basically achieving a "good start". From the perspective of sales of various new energy companies, BYD won the championship with a crushing trend.

★BYD wins the championship strongly

"Qin PLUS"

In February, BYD achieved sales of 193,655 units, an increase of 112.6% year-on-year. Among them, sales of pure electric models were 90,639 units, and PHEV models were 101,025 units. In 2023, 345,000 units have been sold cumulatively. From the perspective of various brands, BYD Dynasty Network sold 140,925 units, and Ocean Network sold 43,414 units; Tengshi brand sold 7,325 units in February.

★GAC Aian returns to 30,000

Data show that GAC Aian achieved sales of 30086 vehicles in February, an increase of 253% year-on-year and 195% month-on-month; the cumulative sales of 40,292 vehicles in January and February 2023 swept away the downturn in January. From the perspective of specific models, the AION Y and AION S models accounted for about 96% of February sales.

"AION S"

★ Ideal to win the new power championship

In February, Li Auto achieved 16,620 deliveries, an increase of 97.5% year-on-year, and the brand’s historical deliveries have reached 289,095 vehicles. Under the trend of continuous sales breakthroughs, Li Auto still has potential to be tapped. Its blockbuster products (|) will be delivered in March this year. After the production capacity climbs, it is expected to provide considerable impetus for the further growth of enterprise sales.

"Ideal L8"

★ NIO sales exceeded 10,000

Data show that NIO delivered 12,157 vehicles in February, an increase of 98.3% year-on-year. Among them, 5,037 SUV models were delivered and 7,120 sedans were delivered. From January to February 2023, NIO delivered a total of 20,663 new cars, an increase of 30.9% year-on-year. As of the end of February, NIO’s new cars have delivered a total of 310,219 vehicles.

"NIO ET7"

★ Nezha performance rebounds

According to the official data released, the Nezha car delivered 10,073 units in February, an increase of 41.5% year-on-year. From the perspective of specific model performance, the Nezha V delivered 5,013 units, the Nezha U car series delivered 3,012 units; and the Nezha S delivered 2,048 units. As of February 2023, the Nezha car has delivered a total of 264,138 units.

"Nezha S"

Changan accuses Geely of plagiarizing the appearance of Galaxy, and Geely refutes

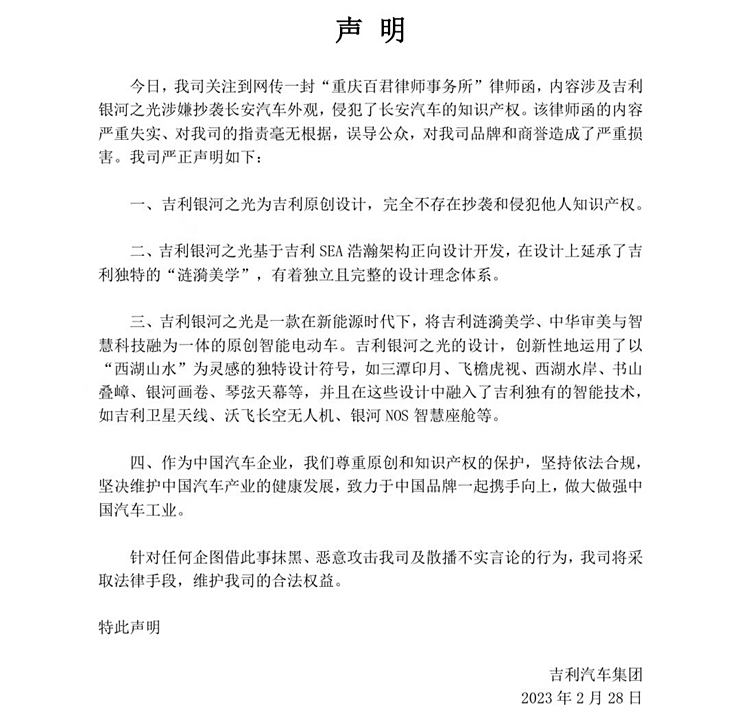

Some time ago, Chongqing Changan Automobile joint stock company issued a lawyer’s letter to Zhejiang Geely Automobile Co., Ltd. and Geely Automobile Group Co., Ltd., accusing the latter of "Galaxy Light" prototype car and Changan Automobile concept car, production car has a lot of similarities, suspected of infringing Changan Automobile intellectual property rights.

In response to the above accusations, Geely Automobile Group issued a statement saying that Geely Galaxy Light is Geely’s original design, which is completely free of plagiarism, and gave the inspiration for many details of the design. Yang Xueliang, senior vice-president of Zhejiang Geely Holding Group, retweeted the statement and said on social media: "We must have healthy competition, not internal strife; we must transform and develop, not fight in the same room; we must be united, not divided and smeared."

"Galactic Light"

It is reported that the Galaxy Light model came from Chen Zheng. Chen Zheng served as the global design director of Changan Automobile Group and worked under Changan for more than 20 years. Chen Zheng left at the end of 2021 and joined Geely Automobile in February 2022 as the vice president of Geely Automobile Group. His first work in the Geely era was Galaxy Light.

Annual revenue 45.29 billion ideal release of 2022 financial results

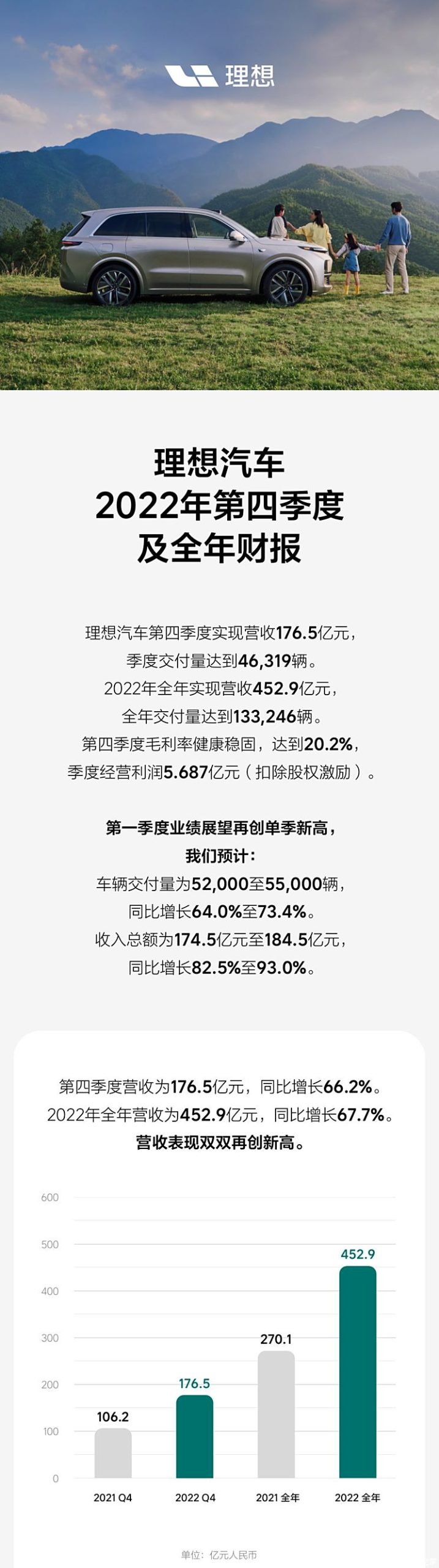

On Monday, Li Auto announced the fourth quarter and full year earnings of 2022. Data show that the company achieved revenue of 17.65 billion yuan in the fourth quarter, an increase of 66.2% year-on-year; gross profit margin returned to health, reaching 20.2%; quarterly operating profit was 568.70 million yuan. Annual revenue was 45.29 billion yuan, an increase of 67.7% year-on-year; annual gross profit reached 19.4%.

In the field of research and development, the company’s R & D investment in the fourth quarter of 2022 was 2.07 billion yuan, an increase of 68.3% year-on-year; the R & D investment in 2022 was 6.78 billion yuan, an increase of 106.3% year-on-year. In the case of increasing R & D investment, as of the end of the fourth quarter, Li Auto’s cash reserves reached 58.45 billion yuan.

In terms of channel construction, as of January 31, 2023, Li Auto had 296 retail centers across the country, covering 123 cities; 320 after-sales maintenance centers and authorized plate spray centers, covering 222 cities. The ideal sales expenses in 2022 are already lower than R & D expenses.

Facing the future, Li Auto expects to deliver 5.2-5 5,000 units in Quarter 1 in 2023, an increase of 64.0% to 73.4% year-on-year. According to Li Xiang, founder, chairperson and CEO of Li Auto, the company will challenge to win 20% market share in the entire luxury SUV market in the price range of 300,000 yuan to 500,000 yuan. It plans to build 3,000 overcharging piles by 2025, with a total cost of 10 billion

Total revenue 49.27 billion yuan NIO released 2022 financial results

On March 1, NIO released the fourth quarter and full year earnings of 2022. The report shows that the company achieved revenue of 16.06 billion yuan in the fourth quarter of 2022, an increase of 62.2% year-on-year, and positive growth for 11 consecutive quarters. R & D expenditure 3.98 billion yuan. The total revenue of 2022 reached 49.27 billion yuan, and the total R & D expenditure was 10.84 billion yuan; the cash reserve was 45.50 billion yuan.

Although revenue hit a new high, the company’s losses further expanded. Data show that in 2022, NIO’s operating loss was 15.641 billion yuan, an increase of 247.9% year-on-year; net loss was 14.437 billion yuan, an increase of 259.4% year-on-year; gross profit was 514 million yuan, a decrease of 24.6% year-on-year.

Facing 2023, NIO’s guidance on delivery is Quarter 1 to achieve 31,000 – 33,000 vehicles, and Quarter 1 revenue guidance is 10.62 billion yuan – 11.54 billion yuan. Since the company is currently in the transition period from NT1 to NT2 platform, there are measures such as vehicle clearance, national subsidy withdrawal, and financial interest discounts. Superimposed Q1 main delivery models are ET5, with low gross profit, resulting in greater pressure on Quarter 1’s overall financial indicators.

Li Bin, chairperson of NIO, said that if raw material prices reach the expected rate of decline according to the current trend, NIO will be on track to achieve the goal of break-even in the fourth quarter of 2023. In terms of sales volume, NIO’s sales target in 2023 is to double compared with 2022, about 250,000 vehicles. With the successive delivery of ET5 Touring, new ES6, new ES8 and other models, the overall product portfolio is expected to achieve the monthly sales target of 30,000 vehicles.

BYD will launch a new brand

BYD officially announced that it will launch a new professional personalized brand. In the future, its product matrix will include sports cars, off-road, coupe and other categories. The first mass-produced product will be a hard-core off-road product, which will be benchmarked against the Mercedes-Benz G-Class. Previously, some sources said that the overall price positioning of the brand will be comparable to that of luxury car brands such as BBA.

At present, BYD owns the BYD brand (Dynasty Network + Ocean Network), the Tengshi brand, and the Yangwang brand, etc., and the positioning and distinction between each brand are more obvious. The new brand to be launched this time will be internally codenamed "F Brand", which will be between Tengshi and Yangwang. And this brand is also the key layout for BYD to complete the coverage of "from home to luxury, from mass to personalization".

Previously, the consulting firm Reese has criticized BYD’s internal brand/category planning in the form of a report. The company believes that BYD has exploded in the layout of categories, but there is some confusion in the brand planning. The hidden danger is that BYD’s single brand covers multiple categories, which can easily lead to cognitive ambiguity; if multiple models are deployed in the same price range, the car sea strategy will lead to serious internal friction in the brand; if high-end brands lack category planning, the group will be hindered.

With the successive launch of new brands such as Yangwang and "F Brand", BYD’s overall development layout will undoubtedly become clearer. (Text/Autohome Chen Can)